Compare a High-Interest in Australia

Savings Account with Coinhold

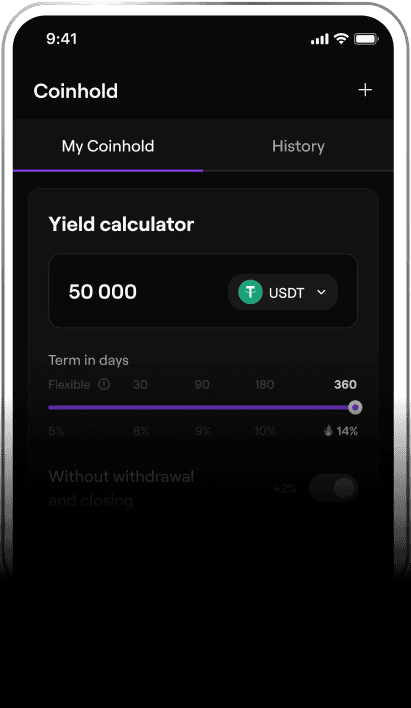

up to 14% APY

A crypto savings wallet* for those who recognize the benefits of storing their savings in cryptocurrency.

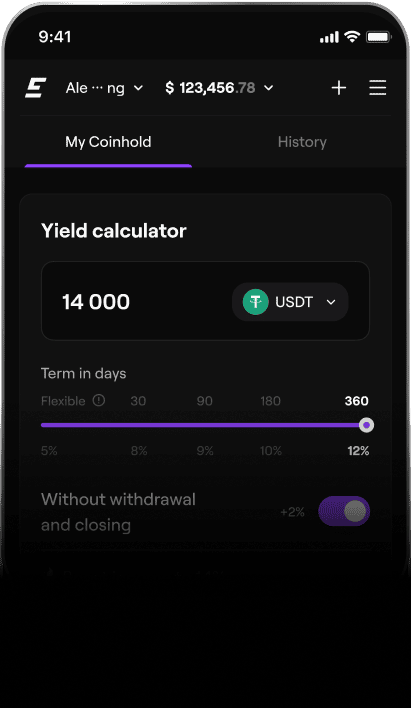

Calculate your Coinhold income

Interest is higher, but you can only close the wallet and withdraw funds at the end of the term

on Crypto Market

How can I help you?

Coinhold and Its Advantages

Over Traditional Banks

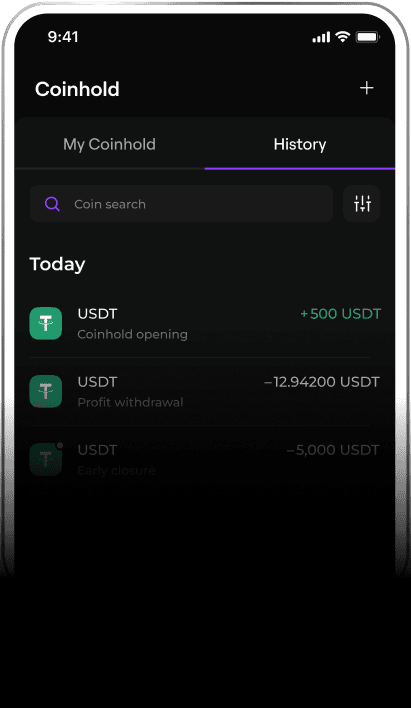

EMCD Coinhold is a savings wallet that enables you to earn additional income of up to 12% annually through cryptocurrency storage. You can store one of 6 coins such as USDT and BTC.

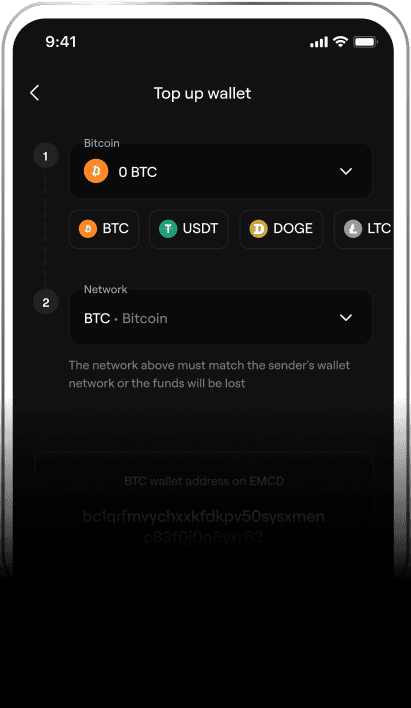

The funds that users deposit into EMCD Coinhold serve as liquidity for internal exchanges within our application. It's essential to emphasize that we do not place these funds on external trading platforms or invest them in high-risk DeFi instruments, as we prioritize the security of our customers' funds.

This innovative approach can yield significantly higher returns than

traditional term deposits offered by banks.

and USDC?

USDT with up to 14% APY

A widely used stablecoin that maintains its value by being backed by reserves, ensuring it is always worth approximately one US dollar. This makes it a popular choice for trading and holding in the crypto market.

USDC with up to 14% APY

Another stablecoin pegged to the US dollar, known for its transparency and compliance with regulations. USDC is backed by fully reserved assets and is widely used for transactions and savings in the cryptocurrency ecosystem.

vs. Australian Bank Rates

When comparing EMCD Coinhold rates with Australian bank term deposit rates, the difference is striking. While banks typically offer fixed interest rates that hover around 4% to 5% for term deposits, Coinhold can provide significantly higher APYs of up to 14%, depending on market conditions and assets. Here's how they stack up:

Bank Term Deposit Example:

If you deposit $40,000 in a bank for a 12-month term deposit at a fixed rate of 5%, you will earn $2,000 in interest by maturity, totaling $42,000.

EMCD Coinhold Example:

If you invest the same $40,000 in USDT or USDC with an APY of 12%, you could earn $4,800 in interest over the same 12 months, resulting in a total of $44,800.

Is EMCD Coinhold Right for Me?

Investing in EMCD Coinhold can be an excellent option for those seeking higher returns on their investments without the lengthy lock-in periods of traditional term deposits. However, it’s essential to consider your risk tolerance and investment goals, as cryptocurrencies can be volatile.

EMCD Coinhold

Pros

- High APY: Typically offers much higher returns than traditional bank deposits.

- Flexibility: Users may have more options regarding access to their funds.

- Stablecoin Security: USDT and USDC provide a stable investment environment due to their dollar peg.

Cons

- Market Volatility: While stablecoins are less volatile than many cryptocurrencies, they still carry risk.

- Regulatory Changes: The crypto market is subject to regulations that could impact returns.