How RWA Drives Profitability in DeFi

Decentralized finance (DeFi) has long moved beyond purely digital assets. Today, it’s increasingly integrating with the real world. One of the most prominent trends of recent years has been the integration of RWA (Real World Assets) into DeFi. These tangible assets provide real-world collateral, making returns in the crypto economy more stable and predictable.

In this article, you’ll discover how RWA work with DeFi protocols, which assets are most commonly tokenized, and how they contribute to generating passive income.

RWA in DeFi: What It Is and Why It Matters for the Future of Finance

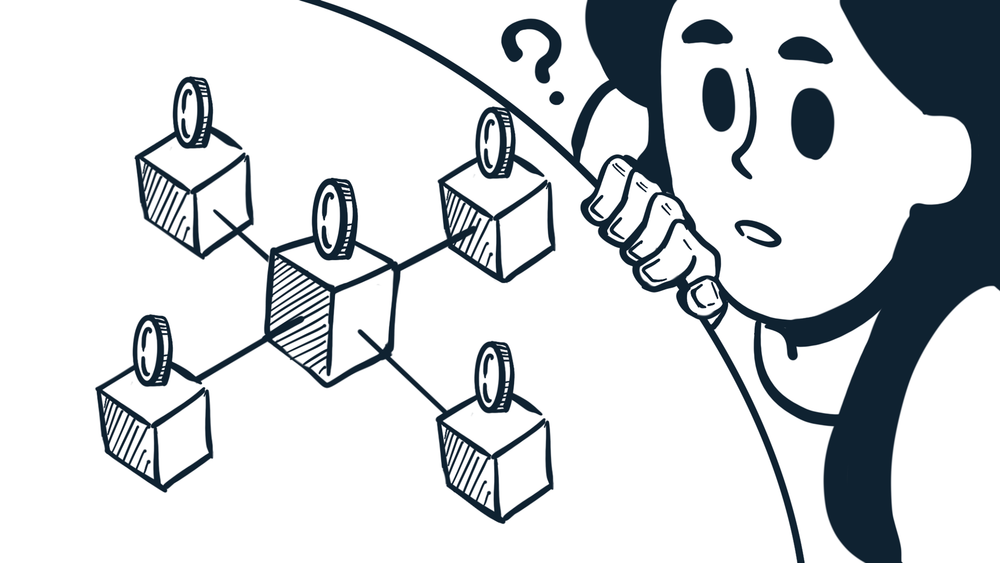

RWA refers to real-world assets tokenized on the blockchain. Unlike purely digital instruments, RWAs are tied to tangible sources of value, such as real estate, bonds, commodities, or cash flow from real businesses.

DeFi protocols integrate these tokens into their ecosystems to generate stable returns, reduce volatility, and create new liquidity sources.

RWA make DeFi more understandable and reliable for the average investor, as returns are based on real, not just speculative, flows.

Which RWA Are Commonly Used in Crypto Finance?

Today, the largest protocols focus on understandable and predictable asset classes. This approach minimizes risks and ensures regular payouts to participants.

Here are the most common asset categories:

- Government bonds and securities. Stable income from U.S. T-bills has become an APY source in many DeFi solutions

- Real estate. Tokenized apartments and commercial properties offer rental yields through DeFi

- Short-term loans. Tokenization of receivables and corporate loans opens access to business income

- Commodity assets. Metals, grain, and energy can all be tokenized and deployed in protocols

These assets generate returns not from crypto volatility, but from real cash flows, making them especially valuable in times of market instability.

How RWA and DeFi Protocols Work Together

RWA tokens enter DeFi through smart contracts and integrations with platforms that provide legal and technical infrastructure. Once in the ecosystem, the tokens are used in familiar mechanisms:

- Staking. Lock your RWA tokens to earn returns from the underlying assets

- Farming. Place your tokens in liquidity pools and earn native protocol tokens as rewards

- Lending. Use RWA as collateral for crypto loans or lend liquidity in exchange for interest

Returns are not dependent on the price of BTC or ETH, but on rental payments, bond interest rates, or income from real-world sales. This makes RWA more resilient during turbulent periods.

RWA Advantages of RWA for Investors

Integrating with the real world makes DeFi returns more accessible and less speculative. You’re not just getting digital tokens, but assets backed by economic fundamentals.

Here are the key advantages:

Transparency and inherent value

- Lower volatility compared to altcoins

- Stable income sources

Access to investments previously unavailable to retail investors

RWA allow you to leverage DeFi’s strengths — automation, transparency, and control — while benefiting from the reliability of traditional financial instruments.

What to Consider Before Investing in RWA

Despite the advantages, investing in RWA through DeFi requires attention to detail. The asset should be legally verified, the token transparent, and the protocol secure. Failing to verify these details may expose you to certain risks:

Jurisdiction and Regulation

- Dependence on intermediaries and tokenization providers

- Limited liquidity in early stages

- Potential payment delays

Choose projects with licenses, reputable RWA providers, and integration with major DeFi platforms. This way, you minimize risks and increase your chances of stable returns.

How to Start Earning from RWA with EMCD Coinhold

If you want to earn crypto income without relying solely on token prices, start with real assets. EMCD Coinhold offers a simple and secure way to earn returns, including from tokenized RWA.

EMCD Coinhold bridges the benefits of decentralized finance with the real economy. Join today to earn thoughtfully and sustainably.