What’s Better: Manual Trading or Investing in an Index

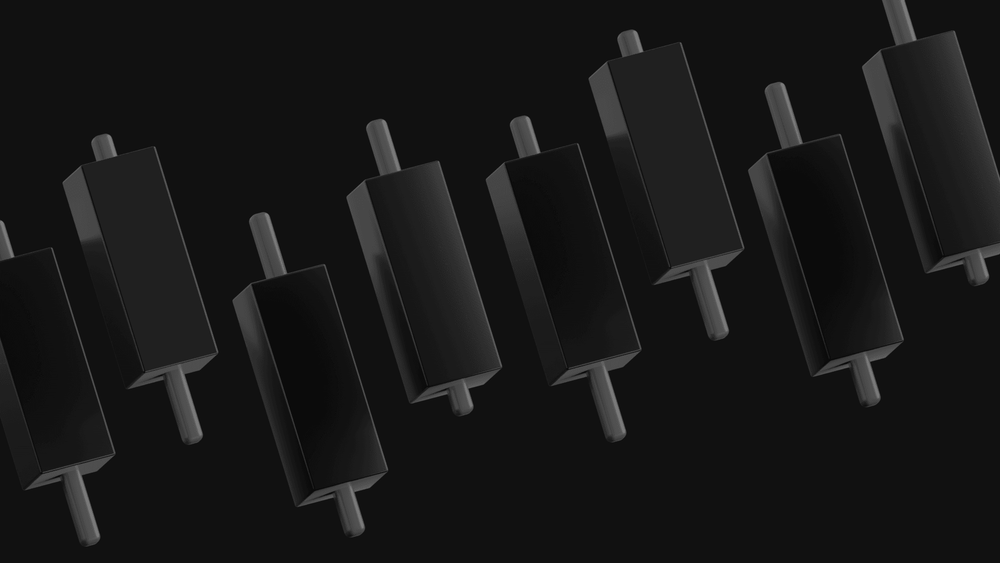

The question of manual trading vs index investing continues to shape debates among both retail and professional investors. Each approach offers distinct pros and cons, demanding different skills, goals, and time commitments. Manual strategies focus on market timing and control, while index-based approaches prioritise diversification and long-term stability. Understanding what defines each style, and when to use them, helps investors decide how to balance flexibility with structure.

Understanding manual trading

Manual trading means executing buy and sell orders personally, without automation. The trader analyses charts, indicators, and news to make independent decisions. This process provides full control and emotional engagement, but it is also highly demanding and often required daily attention.

Many crypto users prefer manual execution for its sense of ownership and direct influence over results. Platforms such as EMCD P2P offer tools to manage this process securely, allowing users to trade instead of relying on third-party managers.

| Pros of manual trading | Cons of manual trading |

| Direct control over every deal | High stress and emotional pressure |

| Fast reactions to price swings | Time and knowledge required |

| Opportunity for short-term gains | Risk of impulsive decisions |

| Educational experience | Market monitoring is constant |

The main benefits lie in learning, autonomy, and potential for profit during volatility. Yet these come at the cost of effort and consistency.

How index investing works

Index investing takes a passive approach. Investors invest in a fund that mirrors a chosen market benchmark, such as a stock or crypto index. The goal is to follow, not beat, the market.

In practice, this means fewer trades and lower fees. Index funds rebalance automatically, providing stability and long-term compounding. In digital finance, tools such as EMCD Coinhold represent similar logic, enabling users to hold diversified crypto assets and earn without daily intervention.

| Pros of index investing | Cons of index investing |

| Easy to start and maintain | Limited flexibility |

| Lower risk through diversification | Returns depend on market cycles |

| Low fees and predictable structure | Less control for the trader |

| Consistent long-term growth | Few opportunities for fast gains |

Active trading vs passive investing: how they differ

The comparison of active trading vs passive investing often centres on control, risk, and time. Active traders rely on quick reactions and market awareness, while passive investors depend on steady exposure and compounding over years.

| Feature | Active trading | Passive investing |

| Goal | Capture short-term profit | Mirror overall market performance |

| Effort required | High | Low |

| Risk profile | Elevated | Moderate |

| Knowledge | Technical and analytical | Basic understanding |

| Example tools | P2P Trading, signals | Coinhold, index funds |

Both offer clear pros and cons. Active strategies may outperform during volatility, but they require discipline and constant engagement. Passive methods reduce effort and stress, yet limit the ability to invest opportunistically.

Comparing day trading with index-based approaches

When evaluating whether is day trading better than index funds, investors should consider personality and lifestyle. Day trading allows instant reactions, yet every decision carries risk. A trader must stay alert, handle data pressure, and manage emotions daily.

Index funds appeal instead to those who prefer consistent returns and structured exposure. They provide the benefits of diversification, automation, and simplicity, with fewer decisions required. Platforms like EMCD Wallet support both sides of this equation, combining manual and long-term investment features for a unified experience.

Neither method is inherently better. The difference lies in how much control and involvement an investor seeks.

How to decide between manual trading and index investing

Choosing between trading and investing depends on what matters most: speed or sustainability. The table below summarises key contrasts to help investors decide rationally.

| Criterion | Manual trading | Index investing |

| Time commitment | High, requires full focus | Low, mostly automated |

| Skill level | Advanced technical knowledge required | Minimal expertise required |

| Effort | Continuous activity | Set-and-forget |

| Main benefits | Control, learning, flexibility | Consistency, balance, scalability |

| Common EMCD tools | P2P Trading | Coinhold |

Some investors use both, trading manually with a portion of funds while keeping the rest invested passively. This blended approach helps diversify not only assets but also effort and emotion.

The role of crypto in the balance

In crypto, both strategies gain new dimensions. Volatility favours traders, while the growing range of index and hold products supports passive participants. Within ecosystems like EMCD, users can trade manually, invest automatically, or combine both — deciding instead of being confined to one method.

Crypto makes the contrast between control and automation clearer than ever. Understanding where each delivers benefits allows smarter allocation across tools, timing, and risk levels.

FAQ

What is manual trading?

It is the process where a trader personally executes every order using analysis and judgement rather than automation.

What are the benefits of index investing?

Diversification, simplicity, and reduced emotional involvement.

What should beginners choose?

Beginners should start with structured exposure through funds or hold products and experiment later with manual strategies.

Conclusion

Comparing manual trading and index-based strategies highlights more than a difference in style; it reflects how investors relate to markets. Manual trading rewards initiative and adaptability, while index investing rewards patience and discipline.

Platforms such as EMCD Wallet, Coinhold, and P2P Trading make it possible to invest across both models within one environment, giving investors freedom to decide when to act manually and when to rely on automation instead. The smartest portfolios often find balance between the two, blending control, structure, and learning into one cohesive financial strategy.