How to Take Profits in Cryptocurrency

In investments, the main goal isn’t to earn the most as quickly as possible but to take these profits – otherwise, all your profits will dissolve before your eyes.

What’s profit taking?

Profit taking at the stock exchange means successfully selling an asset at a higher price than its initial purchase, locking the profits. The investor's activity is basically summarized as searching for opportunities to get and literally take their profit — that’s where the self-explanatory term comes from. There are many elaborate strategies for classic investment assets. However, in the cryptocurrency market, it can be difficult for a beginner to understand the opportunities available and choose valid tools.

So if you want to successfully ‘take profits’ in the crypto market and properly manage your investments – read on and start earning on crypto. To put this knowledge into practice, open a wallet or join the mining pool at EMCD.

What methods can I use to secure profits in crypto?

The crypto market is usually almost synonymously associated with volatility – simply put, the prices of digital coins change very quickly and unpredictably. That’s why, to lock in profits, you need to exchange your volatile assets for more stable ones over time. The most popular ways of profit-taking:

- Withdrawing to fiat – you can simply exchange crypto for USD or other “regular” currency

- Switching to stablecoins – coins with rates pegged to the dollar, gold, or other stable assets

- Transferring to another cryptocurrency – if you see a profit when trading a relatively obscure coin, you can lock it in by exchanging it into BTC, ETH, or other more stable currencies

- Buying other assets – you can buy gold, company shares, tech, and other valuables with crypto

The most reliable way to lock in your profits is to withdraw into fiat or stablecoins. However, buying more valuable assets allows you to increase your income — withdrawing to fiat or stablecoins will help you lock your profits today, but will cut your opportunity costs unless you reinvest that money right away. For example, you can convert your profits into stablecoins and put them into a Coinhold savings wallet for up to 14% annually as a low-risk option.

What perfect profit-taking looks like

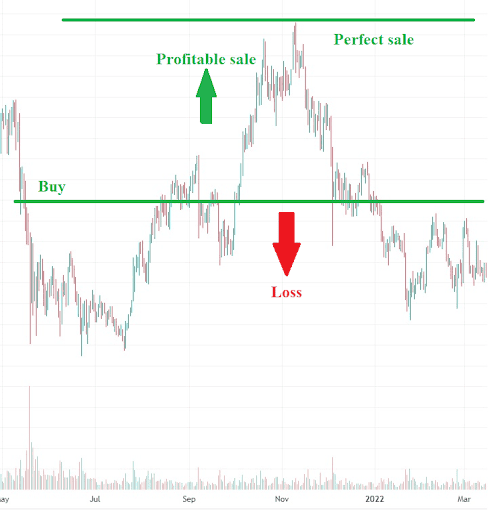

The perfect profit-taking on the exchange basically means ‘selling high’ – in other words, at the moment of maximum price. It means that to get the maximum profit you should be able to sell the coin when it gains the highest value for a taken period. An example of perfect profit-taking can be seen on the chart.

All sales at moments above the lower green line (the value of the purchase price) will be profitable to varying degrees. But all sales below this line will be unprofitable.

But in reality, perfect profit-taking can only be achieved by chance. Very often the growth of a coin is accompanied by short periods of decline. And even the most experienced crypto experts cannot accurately assess the future growth prospects of any cryptocurrency.

A confident sale on the ultimate maximal cost is an unattainable ideal. However different methods of analysis do help forecast the development of trends with varying accuracy, but don’t get caught up in ‘timing the market’ – you won’t catch all the highs and that’s okay, that’s why you diversify.

When and how to take profits on the crypto market

Long-term investing involves finding your own strategies. That’s why even the most experienced and successful traders are not ready to give recommendations on how to take profits correctly and when it’s better to do it — there’s just no one-size-fits-all solution. But these generic tips can be helpful to get you started:

- Analyze rate dynamics based on news and advanced economic statistics (fundamental analysis).

- Forecast based on the general laws of movement of asset charts (technical analysis)

- Set profit limits or withdraw the equivalent of what you invested immediately after making a profit on a high-risk asset and transfer it to low-risk investments – helps to ensure that you don't go to zero and keep the chances of making even more

- Study expert recommendations, but don’t blindly copy strategies that might not work for your circumstances

Each method has its advantages and disadvantages, and even though analyzing average asset returns based on long-term performance, it’s still not a magic crystal ball.

- Fundamental analysis gives decent accuracy, but it is time-consuming and requires deep knowledge – it might take you longer to analyze a volatile asset than that asset is even worth holding on to

- Technical analysis helps to make quick conclusions but rarely helps calculate the exact moment of maximum profit taking, you still won’t be able to time the market with this

- Profit limits and withdrawing your starting capital help get to a guaranteed profit, but it’s a really complex process if you’re going to offset your opportunity costs

- Expert recommendations can help even a complete beginner to trade, but it would be a shame to lose money because of other people's mistakes

How to reduce risks

One of the simplest keys is to balance your portfolio. You don’t want to have all your money sitting there in fiat without earning any income, it will just devalue over time because of inflation and cost you enormous sums over time in opportunity costs and loss of compound interest. However, you also don’t want to throw everything you have into a high-risk asset and lose your shirt in a day.

Experts generally recommend an 80/20 balance, meaning that you have 80% in low-risk and 20% in high-risk investments, but you can adjust this balance according to your personal comfort levels. Here are some basics to keep in mind:

- Limit your investments into individual assets – ‘don't put all your eggs in one basket’

- Don’t use leverage you can’t afford

- Don’t chase ‘the next Bitcoin’, you won’t find it

- Don’t panic with the market and lock your losses instead of profits

A smart, safe strategy for a beginner is to gradually build up capital instead of trying to make huge profits at once. This way you can accumulate money and experience for really successful investments.