P2P Trading: Methods, Schemes, Safety Rules

What is it? P2P trading is the buying and selling of cryptocurrency or fiat currency using crypto between two users without intermediaries. In practice, such transactions are quite risky, and often parties prefer to trade with the involvement of guarantors: exchanges or special services.

How? P2P trading involves placing a request and an offer. Participants accept the terms and make a deal to get what they need. There are various earning schemes in P2P trading, but there are even more fraud schemes.

All information contained in the article is published on the principle of objectivity and for informational purposes only. The reader is solely responsible for any actions taken based on the information obtained from the article.

What is P2P Trading?

The P2P trading scheme involves direct interaction between the buyer and the seller without an intermediary. A traditional crypto exchange operates on behalf of the client, with the final asset price determined by its market value at the time of the transaction. In the case of P2P trading, cryptocurrency transactions are conducted directly between the participants under pre-agreed conditions. Since there is no third party involved, certain risks arise during transactions. To minimize these risks, some major platforms implement various measures such as offering escrow accounts, providing feedback mechanisms, and creating user ratings. However, if trading is conducted outside such a platform, people are at a high risk of encountering fraudsters.

A P2P exchange is essentially a place where buyers and sellers meet. The transaction between them is made on mutually beneficial terms. One participant posts an advertisement specifying the type of cryptocurrency, the exact buying and selling price, and payment methods. The other party finds this advertisement and, if the terms are acceptable, places an order to make a deal with this counterparty. Platforms provide a wide range of search filters to find suitable offers. You can choose counterparties by location, payment methods, rating, and verification status. Most P2P platforms offer specific information about sellers, including the number of completed transactions, counterparty reviews, and trading volumes.

The platform also ensures the transparency and fairness of transactions and acts as an arbitrator in case of disputes between participants. As mentioned earlier, many exchanges introduce so-called escrow accounts for conditional asset deposits during transactions. These accounts are used to temporarily hold funds until the buyer makes the payment.

Not all P2P platforms require participants to undergo verification. Sometimes, it is enough to provide a phone number or email address. However, in some cases, people need to verify their identity and then enable two-factor authentication using Google Authenticator. To increase trading limits, participants may need to provide additional information, but usually, basic personal information is sufficient.

Recently, the popularity of Telegram bots that automate P2P trading has been growing. There are two types of such electronic bots: standalone exchangers and programs linked to a specific P2P platform. In the first case, the bot acts as an analog of a standard exchange service.

To attract new users, cryptocurrency platforms introduce a referral system. The reward for attracting a referral is calculated as a percentage of the commission from each transaction made by the referral. Platforms are constantly trying to improve functionality for users.

Advantages and Disadvantages of P2P Trading

Let’s start with the advantages.

Favorable Conditions: P2P platforms offer the most favorable conditions for buying and selling crypto.

Simplicity: Automation is not necessary to make a profit. It is enough to create a wallet and keep a simple accounting table.

Reputation: Trading on the exchange increases the participant’s rating, which positively affects the trust of buyers.

Now, let’s list the main disadvantages.

Illegal Funds: Such exchanges may involve illegal money.

Therefore, it is necessary to keep records of users, possibly with identity verification. Banks and payment systems may raise claims, requiring legal protection to resolve.

Transaction Limits: There is a possibility of exceeding the limits on the volume of exchange operations, which may result in fiat cards being blocked. Therefore, users are recommended to verify in payment services in advance and ensure tax reporting.

Fraud: There are many fraudsters registered on these platforms who constantly come up with new ways to deceive users. For example, they send much smaller amounts, forge receipts, request refunds for allegedly mistakenly sent funds, etc. Arbitration is provided for such cases, authorized to freeze suspicious transactions. For this, you need to contact support chat.

3 Ways to Participate in P2P Trading

P2P companies provide the opportunity to invest in cryptocurrency, where people trade directly with each other and do not pay commission fees like on traditional exchanges. Below are three ways to earn from P2P trading that may be the most optimal options.

Arbitrage Cryptocurrency Trading This is a trading strategy based on making a profit by buying digital currency on one exchange and selling it on another at different prices. The price difference is the main condition for arbitrage trading. This is a great option for those who want to understand how P2P trading works. Due to the significant price difference between different exchanges, traders discover many opportunities for profit.

It is believed that market risks are absent when making deals within the framework of arbitrage. Nevertheless, the trader needs to make decisions quickly due to the short-lived nature of profitable arbitrage “windows.”

What causes the price difference?

First, let’s understand the terminology.

Liquidity: The ability of an asset to be quickly sold at a near-market price.

Quotation: The price of a financial asset announced by the seller or buyer.

Transaction: A fully completed operation of transferring a certain amount from one account to another.

The price difference arises due to the varying liquidity of exchange trading. Large trading platforms have more active traders than smaller ones, so their quotations are closer to the market price.

Arbitrage also largely depends on the size of the commission. The more expensive the transaction, the fewer participants are willing to make deals. Consequently, the likelihood of price differences between large and small crypto exchanges increases.

Each trading platform establishes its own supply and demand ratio, different from those on other exchanges. This is a natural situation, similar to the price differences for the same products in neighboring stores.

The task of an arbitrage trader is to correctly use this price difference to guarantee a profit regardless of the market direction.

For example, an arbitrage trader is ready to allocate $28,000 for P2P trading. How can they earn using this capital? The general action plan would be as follows:

- Finding an Exchange with the Lowest Purchase Rate

For example, on the Binance platform, a Bitcoin coin is selected at a price of $28,000.

- Buying the Asset and Finding Another Exchange with a Higher Selling Rate

Another platform is found that buys Bitcoin for $28,200, taking into account all commission fees. As a result, the arbitrage trader earns a net profit of $200 from this operation. They just need to transfer the funds.

For simplicity, an ideal example is presented here, which is practically non-existent in reality. In practice, traders manage to earn no more than 1% of the investment amount in this way. Moreover, to achieve such a result, it will be necessary to look for profitable offers and make more than five iterations of buying and selling.

Fiat Currency Arbitrage

Arbitrage trading on P2P platforms also involves the use of fiat currencies. For example, the Bybit exchange offers more than 30 such fiats, including rubles. This is more than enough for comfortable arbitrage. However, in any case, preliminary study of the available opportunities and necessary calculations will be required. As an example, let’s consider an arbitrage situation in the market of US dollars (USD) and Australian dollars (AUD).

BTC/USDT Suppose you can buy Bitcoin for $21,328 (30,926 AUD) and sell it for $20,872 (30,265 AUD). Using only this market, the trader will incur a loss equal to the difference in selling and buying prices ($456).

BTC/AUD Bitcoin can be bought for 28,796 AUD ($19,852) and sold for 29,174 AUD ($20,112). Using only this market, the trader will make a profit equal to the difference in selling and buying prices (378 AUD).

Thus, trading in the US market will be unprofitable. But with a multi-currency bank account, you can buy Bitcoin for 28,796 AUD and sell it for $20,872, thus making a higher profit than using only the Australian account. In total, the arbitrage trader will earn 1,496 AUD (30,265 AUD − 28,796 AUD).

Placing a Sale and Purchase

Order P2P platforms allow users to post ads about their intention to buy or sell cryptocurrency at a specified price. Accordingly, other exchange participants can make deals with sellers (buyers) if the offers suit them.

The user whose ad is responded to will receive a corresponding request to buy or sell. If both parties are satisfied, the deal is made.

To increase audience coverage, it is advisable to set a price below the market price. But ultimately, this is up to the user.

3 Types of Arbitrage Cryptocurrency Trading

- Cross-Exchange Arbitrage

This method implements the classic scheme described above. Currency is bought at a low price on one exchange and then sold at a higher price on another exchange.

- Triangular Arbitrage

Here, trading is conducted on one platform, but three different currencies are used. Profit is generated from the difference in their prices. The strategy is based on the phenomenon of one coin being excessively overvalued relative to the second and simultaneously significantly undervalued relative to the third. This type of arbitrage is advantageous compared to the classic one because all operations are carried out within one exchange, eliminating the need to pay fees for inter-exchange transactions.

- Cross-Border Arbitrage

Many may be interested in this type of arbitrage in P2P trading. What is it, and how profitable is such trading? The profit in the cross-border scheme is derived from the difference in currency rates on exchanges belonging to different jurisdictions. Regional restrictions set for international transactions lead to price differences for the same cryptocurrency in two different countries. Arbitrage traders take advantage of this feature.

It should be noted that arbitrage in any form is a rather specific activity requiring special knowledge. One should not expect easy earnings here. An inexperienced trader will need reliable and understandable sources of information about cryptocurrency arbitrage with typical scheme examples. Most often, Telegram channels are used for this purpose. It is important that all information is provided openly and for free. Such channels should also avoid dubious methods of attracting users, such as account promotion, etc. Even if a truly profitable scheme is found, it needs to be tested on a real account. It is quite likely that such a scheme has already lost its relevance.

Ways to Reduce the Risk of Account Blocking in P2P Trading

To avoid raising suspicions with the bank, you should use your account for its intended purpose and avoid potentially suspicious operations. Trading on a P2P exchange, provided that the law is followed, is not a criterion that can attract the attention of the financial monitoring service. However, the risk of account blocking still exists.

The best advice for traders is to follow the rules below to minimize the risk of blocking by the bank:

- Don’t transfer money and top up your account too often, especially with large amounts. It is recommended to adhere to the established norm

- It is advisable to buy and exchange cryptocurrency not daily and not more than once a day.

- Account top-ups of more than 100,000 rubles per day will definitely raise suspicions with the bank. It is important to remember this. Even for self-employed individuals, the maximum allowed income is 2,400,000 rubles. And the official salary of an employee should be even less, according to the bank.

- Cash out funds from the card as rarely as possible.

- The card linked to the account should also be used for purchases and payment of various household services.

- Profits from trading are subject to taxes. Do not forget about this.

- Before transferring money withdrawn from the trading account to another person, it is advisable to wait about a day.

Common Fraud Schemes in P2P Trading

As in any other profitable area, fraudsters using well-established schemes can operate here. Bright advertising of a P2P platform does not mean that it is 100% reliable. To avoid encountering these schemes, it is useful to study them and try to avoid them in the future. Our memo in this section will help with this.

- “Triangle”

First option. This fraudulent scheme is most common in P2P trading. The essence is in the participation of a dummy arbitrageur. The fraudster makes deals simultaneously with him and the intended victim. The prepayment is transferred to the arbitrageur’s details, who then sends the transferred funds to the fraudster.

- “Transaction Cancellation”

The trader decides to buy cryptocurrency through an intermediary, not on the exchange. Seeing the crypto in the wallet, the unsuspecting victim sends money to the seller, who suddenly cancels the transaction. As a result, the fraudster receives the payment, and the “sold” crypto is returned to him.

- “Fishermen”

This scheme is used by fraudsters less often than the previous ones. Nevertheless, it should also be mentioned. In this case, the buyer “bites” on a suspiciously favorable coin rate, which suddenly changes to extremely high after the deal is opened. As a result, the client loses their funds. The sharp change in the purchase rate is made by the fraudster through special software.

Most traders encounter fraud on P2P exchanges in one way or another. But beginners who have recently registered on the trading platform are at the greatest risk.

To protect yourself as much as possible from fraudsters, you should avoid using messengers and third-party resources when making deals. The main platforms should be a classic crypto exchange and a P2P service. It is highly recommended to make deals only with users who have built up a high reputation and completed a large number of transactions.

If a person still becomes a victim of fraud and is now involved in a criminal case as a victim, they need to tell the truth during the interrogation with the investigator. Any information explaining the essence of the deal on the trading platform, including correspondence with the seller, will be useful. And let every fraudster get an arrest warrant as soon as possible!

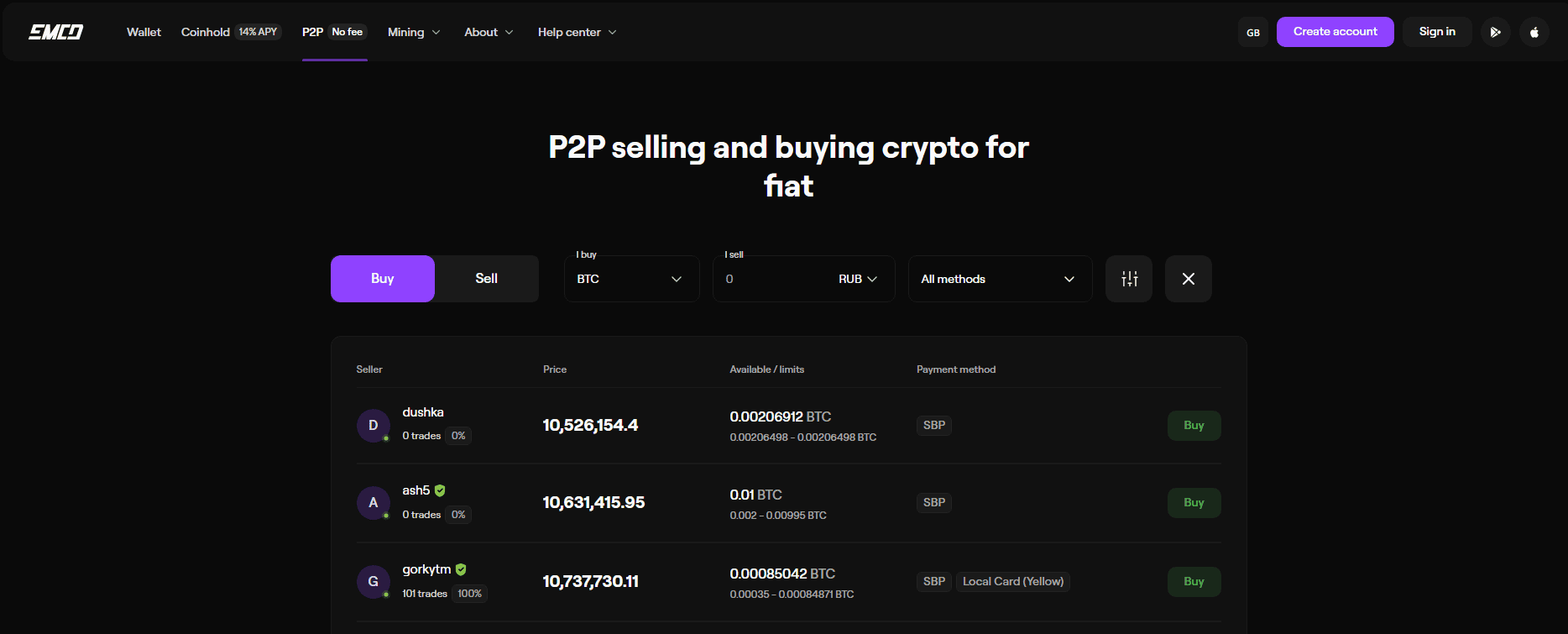

Safe P2P Trading on EMCD

EMCD P2P offers fast and secure transactions, with mandatory verification required to activate trades and ensure trustworthness. Users benefit from access to a wide variety of currencies for greater flexibility.

Trading on EMCD is beneficial for the following reasons:

- Deals can be made without prior verification.

- Many payment methods are available.

- The buyer independently chooses the most advantageous offer.

- Only verified sellers participate.

The procedure is very simple.

- Simple registration on the service.

- Choosing the most advantageous offer from the proposed ones.

- Indicating the details for fiat crediting (when selling cryptocurrency).

- Confirming the deal.

Next, let’s go over the most important points when working with EMCD.

- Opening a Deal

After registration, it is enough to choose a suitable option and make a deal. Further actions are performed according to the service’s instructions. Identity Verification This system does not require users to verify their identity and undergo KYC verification.

- Security

Personal data of clients is not stored on the service.

- Deal Duration

The process can take up to two hours, but usually, it lasts about 5 minutes.

- Guarantees

Until the deal is completed, the funds will be securely frozen within the system. In case of a dispute, you can always contact the support service, which will resolve the situation as quickly as possible.

In conclusion, it should be said that P2P services are just beginning to gain popularity worldwide. This is a more convenient, fast, and profitable way to exchange cryptocurrency compared to exchangers. It is enough to follow the necessary link. Additionally, there is an opportunity to earn extra money on the exchange by charging a certain percentage as a reward. However, there are high risks of encountering fraudsters. The optimal option would be to set a limit of 10% of the total amount and gradually turn this amount over. This is a slow but much more reliable scheme. After all, as you know, it is impossible to get rich quickly in this field without risks.

F.A.Q.

What time of day should you trade cryptocurrency?

The cryptocurrency market operates around the clock. You can trade crypto 24 hours a day, 7 days a week. However, market activity depends on the time of day and region. For example, beginner traders are recommended to trade in the morning: this time is characterized by moderate activity and, therefore, less volatility. It is believed that the highest activity is from noon to evening.

What is the difference between a token and a cryptocurrency?

The main difference is that a cryptocurrency (coin) has its own blockchain, like Ethereum for ETH. Accordingly, tokens are created on existing blockchains. For example, the USDT token operates on seven different blockchains. Tokens can also represent assets, provide access rights to platforms, be used for crowdfunding, and other purposes. A coin, on the other hand, serves as digital money for exchange and payments.

Cryptocurrencies are usually decentralized and governed by algorithms. Tokens can be centralized if managed by a company.

Do cryptocurrency exchanges have working hours?

Cryptocurrency exchanges operate around the clock. This is one of the advantages of the crypto market compared to traditional financial markets, which close on weekends and adhere to strict schedules.

What time do trades open on a cryptocurrency exchange?

Trades on a cryptocurrency exchange never close. You can trade at any time of the day or night.