How was Bitcoin Created: the History of Bitcoin

The history of Bitcoin captivates with its journey as an innovative project that quickly conquered the world and gathered a legion of fans. Its price has surged over the years from $0 to $86 000 — though, of course, it wasn’t without its ups and downs along the way.

Opinion is split on Bitcoin's future: some believe it still has the potential to reach hundreds of thousands of dollars, while others predict a slow slide back to its humble beginnings. To decide which side to trust, it helps to look at Bitcoin’s turbulent history — a story of resilience through countless challenges.

Let’s dive into the Bitcoin world and find out how Bitcoin was created.

Bitcoin’s creation history

Let’s start with the Bitcoin’s creation history.

October 31, 2008, marks the official start of BTC’s journey. On this day, an article titled ‘Bitcoin: A Peer-to-Peer Electronic Cash System’ was released by the mysterious Satoshi Nakamoto. In this document, the protocol for the world’s first cryptocurrency was outlined — a set of rules designed to govern how this groundbreaking new system would function.

It’s worth noting that all this system’s elements were already in existence before this article was written. Cryptographic algorithms — still the Bitcoin’s backbone today — were well established. The same goes for distributed storage technology in decentralized networks, which Bitcoin would later rely on to revolutionize finance.

So, what was the scientific breakthrough in Nakamoto’s work? The novelty lay in the fact that, before him, no one had assembled the separate pieces of a future cryptocurrency into a single, cohesive picture. Satoshi managed to combine these elements and clarify how they could work together. The result was a groundbreaking electronic transaction system where users no longer needed to rely solely on trust. This concept was revolutionary for its time.

A few months after the protocol was released, on January 3, 2009, Nakamoto generated the first block in the blockchain, completing the first-ever Bitcoin transaction. This initial ‘mining’ yielded 50 BTC. Remarkably, Satoshi personally maintained the network throughout 2009, during which he was the sole miner. To this day, it’s estimated that around 1 million Bitcoins remain untouched in wallets believed to belong to Nakamoto.

Thus, Satoshi is considered the founding figure of the world’s first cryptocurrency. Yet no one knows for sure who was truly behind this nickname. Over the past decade, numerous theories have emerged. According to these, Satoshi Nakamoto might be:

- A single person who independently created the Bitcoin protocol

- A scientific group working together

- Intelligence agencies

- Or, more playfully, an alien force, a Masonic organization, or other figures from conspiracy lore

From the very beginning, Bitcoin’s story has been shrouded in mystery. No one can confidently say who hides behind the nickname Satoshi Nakamoto.

On December 12, 2010, the Bitcoin’s protocol creator sent their final message. After that, Satoshi Nakamoto vanished entirely from the internet, ceasing all involvement in developing the world’s first cryptocurrency — at least under that name.

Having reviewed Bitcoin's brief history, let’s analyze its development process outlined in this guide.

Bitcoin’s evolution

The Bitcoin's evolution history can be divided into several key stages:

- Bitcoin’s technology advancement and the increase in computational power used for mining coins

- The infrastructure formation, including exchanges, brokers, wallets, and other services related to cryptocurrency transactions

- The introduction of regulatory measures by governments aimed at controlling Bitcoin

- Fluctuations in the cryptocurrency's value, reflecting both market dynamics and external factors

Keep in mind that these stages didn’t occur sequentially but rather simultaneously. Moreover, they continue to unfold to this day. Bitcoin’s development has profoundly impacted the entire cryptocurrency market, shaping its evolution and influencing trends that persist in the industry.

Let’s take a closer look at some of these stages in more detail.

Bitcoin and Miners’ Technical Development

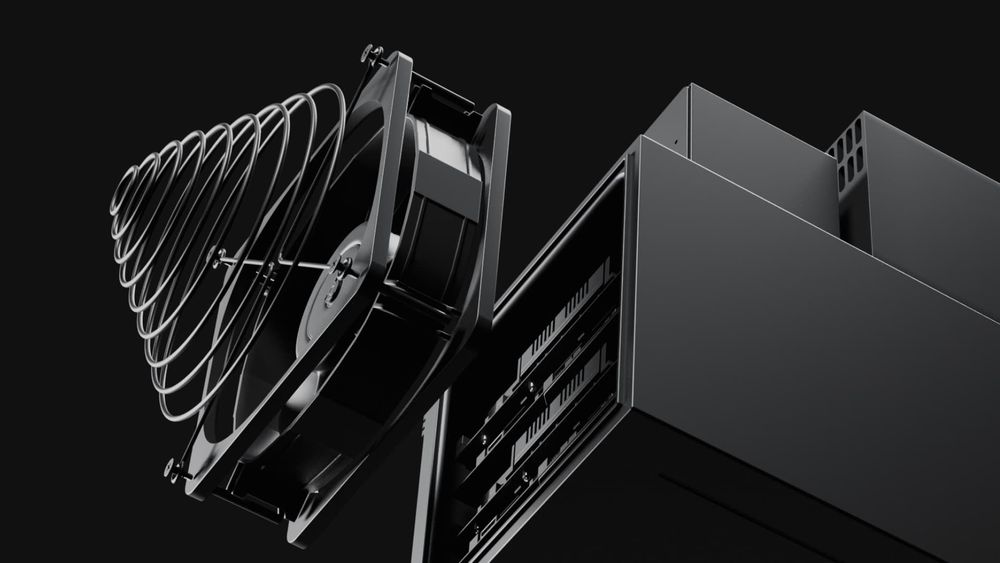

When discussing the Bitcoin’s technical development, it’s important to highlight that progress was driven by an increase in the miners’ computing power. Miners are responsible for calculating the key – hash that validates transactions. Initially, the keys for the first transactions could be computed using a regular PC. However, as mining speeds increased, so did the competition among miners. This led to the development of specialized hardware designed specifically for hash calculations, known as ASIC-miners.

Over time, mining pools emerged, grouping multiple miners together. This allowed to create the decentralized computing power, linked via the cloud, to calculate hashes more efficiently.

On June 13, 2011, the system faced a major security breach. On this day, 25 000 coins were stolen from one user's wallet. It’s worth noting that these incidents still occur today, primarily due to the Bitcoin wallets nature, which require both a public and a private key for management. If either of these keys is compromised, the wallet — and its contents — are vulnerable to theft.

It’s also worth mentioning the issues within the protocol itself. On August 15, 2010, a bug in the code resulted in what became known as a ‘dirty transaction.’ This flaw was quickly addressed and corrected by the network’s users. To further develop the project and attract more miners, significant adjustments began to be made to the code — through forks. The first major fork occurred on August 1, 2017, leading to the split between Bitcoin and Bitcoin Cash. This division was a direct result of these protocol changes.

Bitcoin Market Infrastructure

On February 6, 2010, the first exchange for cryptocurrency trading was launched. Then, on July 17, 2010, the popular exchange MtGox was created. Over the following years, the exchange platforms’ number grew rapidly, although they remained largely localized within the crypto market. Additionally, some forex brokers expanded their services to include cryptocurrencies alongside traditional fiat currencies. However, the largest players in the global financial markets are still developing methods for entering the cryptocurrency space to serve their clients.

It’s also important to highlight the stage when existing electronic payment services were integrated into Bitcoin transactions. In May 2013, the company WebMoney developed the first wallet type that allowed Bitcoin transactions. Shortly after, Bitcoin ATMs were created, enabling users to exchange cryptocurrency for fiat money, further bridging the gap between digital and traditional currencies.

The development of Bitcoin's market infrastructure was also influenced by the new coins creation and projects within the cryptocurrency space. Additionally, a new raising funds method — Initial Coin Offerings — was introduced. Bitcoin was often used as the primary currency for participating in ICOs. This trend continues to this day, with BTC remaining a popular choice for investment in emerging crypto projects.

Bitcoin Market Regulation

On April 16, 2012, an article mentioning Bitcoin was published in The Times. This marked the first time the cryptocurrency was referenced in a major print publication, signaling its growing recognition and interest in the mainstream media.

By August 2013, Germany recognized Bitcoin as a legal currency. However, in December, China shut down one of the world’s largest exchanges — BTC China — and banned the cryptocurrency use within the country. Norway also declined to recognize Bitcoin as legal tender. On January 24, 2014, BTC China resumed operations, despite the regulatory challenges.

In March 2016, Japan recognized digital currencies, including Bitcoin, as a legitimate means of payment, allowing them to be used like fiat money. This decision marked a significant step towards integrating cryptocurrencies into the mainstream financial system.

In 2017, Bitcoin futures were launched on the world’s leading derivatives exchanges — CME and CBOE. This marked a major milestone in the financial Bitcoin integration, allowing investors to trade contracts based on the future cryptocurrency price.

Thus, the Bitcoin market industry has been actively evolving for over a decade. In its early years, the idea that the cryptocurrency sector would become such a vast industry was met with mockery. However, today, Bitcoin stands as one of the most efficient financial tools. While the crypto market has yet to fully penetrate traditional finance, many experts believe it's only a matter of time. Thanks to internet development and computing technologies, Bitcoin has gained widespread recognition among millions of people worldwide and is now used as an alternative to traditional payment methods.

Bitcoin's Price Evolution Over the Years

Bitcoin mining began in 2009, but back then, there was no place to sell it. Cryptocurrency exchanges simply didn’t exist yet, leaving Bitcoin with a starting zero value.

Let’s take a closer look at the Bitcoin’s price evolution over the years:

- 2010

During 2010, Bitcoin's price was still under $1. Yet, it’s worth noting that this cryptocurrency value had already started to climb. A famous example is when Laszlo Hanyecz, an American, bought two pizzas for 10 000 BTC – at the time, each Bitcoin was worth just $0.0025. Clearly, if he had chosen to hold onto his Bitcoins, a decade later, it could have been worth an astonishing $450 million.

It’s important to highlight that 2010 saw the Mt. Gox crypto exchange creation, which later became infamous for a major hacker attacks series.

- 2011

In 2011, the Bitcoin’s price reached $1. Specialized publications like Slashdot and Hacker News started covering cryptocurrency, drawing a surge of new users from Twitter to Bitcoin.org.

From February 25 to 27, 2011, Bitcoin's network hashrate saw a sharp increase, rising from 401 GH/s to 628 GH/s. After that, it gradually decreased to 392 GH/s by March 1. However, the hashrate soon surged again, reaching 774 GH/s.

Hashrate measures the speed at which mining hardware in blockchain networks performs computations. Therefore, an increase in hash rate reflects the growing pace of new miners joining the network.

These events still spark a lot of questions. Many believe that someone used either a supercomputer or network’s bots, leading to speculation about a ‘mysterious miner.’ After this figure appeared, Bitcoin’s hashrate began to rise steadily, reaching a record 15.8 TH/s by June.

In April 2011, TIME, one of the largest publications, dedicated an entire article to Bitcoin. The headline read, ‘Online Cash Bitcoin Could Challenge Governments and Banks.’ This media attention caused a price surge, with Bitcoin reaching $32 in just six days by June 2011. However, not long after, the price dropped back down to $10.

That same month, WikiLeaks began accepting Bitcoin donations.

On June 19, 2011, the Mt. Gox exchange was hacked, causing Bitcoin's price to drop from $17 to just $0.01. Funds were stolen from 60 000 users, with total losses exceeding $8.7 million. A week later, trading on Mt. Gox resumed, but this price drop marked the largest in Bitcoin’s history.

- 2012

At the beginning of 2012, Bitcoin was valued at $4.60. However, by the end of the year, its price had risen to $13.44. That same year, Bitcoin experienced its first halving event.

- 2013

In 2013, Bitcoin’s price reached $1 000. On November 30, it soared to $1 153. This level would remain unbeaten until January 5, 2017.

- 2014-2015

In February 2014, Mt. Gox was once again targeted by hackers. The attackers stole 744 000 Bitcoins, setting an all-time record for the largest theft in Bitcoin’s history.

The hacker attack led to Mt. Gox to declare bankruptcy and shut down. Bitcoin users were understandably alarmed, triggering the first prolonged decline in the cryptocurrency's price. This period became famously known as the ‘crypto winter.’

- 2016

In 2016, Bitcoin underwent another halving. Additionally, Bitfinex was hacked, with 120 000 Bitcoins stolen. That same year, Craig Wright claimed to be the person behind the nickname Satoshi Nakamoto. The Australian entrepreneur and scientist continues to be involved in legal battles with the Bitcoin Core and Bitcoin Cash developers. This is due to the Mt. Gox hack, which resulted in Wright losing access to two of his cryptocurrency wallets.

- 2017

This period in Bitcoin’s price history is one of the most significant. At the beginning of 2017, Bitcoin was priced at $960. By September, it had surged to $5 000. On December 17, the price skyrocketed to a record high of $19 483, with Bitcoin's market capitalization surpassing $330 billion.

- 2018

By the beginning of 2018, Bitcoin was priced at $13 800, but by the end of the year, it had dropped to $3 800. This period is widely considered the second ‘crypto winter.’ On January 17, 2018, Bitcoin's price fell to $9 800. On January 30, social media platforms created by Zuckerberg, Twitter, and Google decided to ban cryptocurrency ads. Additionally, ICOs and binary options were prohibited. These events contributed to Bitcoin's price falling even further.

In the summer of 2018, Zuckerberg decided to lift the ban on cryptocurrency ads, but only after moderation. However, even this move didn’t help Bitcoin’s price return to its previous levels.

Compared to the second half of 2017, by the end of 2018, the cryptocurrency value had dropped by a staggering 80%. Many miners at the time chose to sell their mining rigs due to significant losses.

- 2019

In June 2019, the Bitcoin's price surged to $13 785. During this time, the world’s first cryptocurrency users were actively discussing legal issues, including the SEC's battle over Bitcoin ETFs. Additionally, the institutional Bitcoin service launch, Bakkt, was in the works.

The Bakkt project launched in September of the same year, but it failed to attract the most institutional investors' interest. As a result, over the following months, Bitcoin’s price dropped from $10 036 to $6657.

- 2020

In 2020, cryptocurrency prices began to gradually stabilize. Additionally, many other virtual assets' value started to rise. The global economic crisis triggered by the pandemic not only failed to worsen the cryptocurrency market but also helped digital assets become even more popular than before.

In January 2020, Bitcoin’s price reached $7200. By February, it had risen to $10 500. However, shortly after, a sharp decline occurred, with the price dropping to $3800. Throughout 2020, the price gradually increased, and by December, Bitcoin was trading at $19 000.

Why did this happen? The money supply of the US dollar increased by 22%, while business activity declined due to the pandemic. As a result, the currency faced devaluation, making Bitcoin and other digital assets an attractive alternative for many investors.

At the same time, institutional investors began to invest in Bitcoin. For instance, the company Ruffer decided to allocate 2.5% of its assets into cryptocurrency. The British investment fund stated that this move was necessary as a hedge against the further global fiat currencies devaluation.

In 2020, PayPal, a major payment system, decided to allow cryptocurrency for payments. As a result, demand from the company's customers surged, leading to an increase in transaction limits.

- 2021

In 2021, the Bitcoin's price continued to rise, reaching new heights almost every month. In January, the price was $40 700, and by February 20, it had surged to $57 600. On March 13, it climbed further to $61 100, and just a month later, Bitcoin was trading at $63 600.

After these events, Bitcoin's price began to decline, reaching $48 000. In early May 2021, the price started rising again, reaching $58 000. However, within a few weeks, it fell once more to $32 500.

After that, the digital asset price repeatedly reached the $40 000 mark, but the price kept falling. These fluctuations continued until August 2021, when the coin entered a new growth phase. This trend culminated in early September, when Bitcoin’s price reached $52 500.

However, by mid-September, the Bitcoin's price began to decline again, reaching $43 000. After that, the situation improved, and the price rose to $48 000. But another crash occurred, bringing the value down to nearly $40 000. In the remaining days of the month, Bitcoin traded between $40 000 and $45 000.

On September 30, 2021, the cryptocurrency market saw a sharp upward surge. It first broke the $50 000 mark, setting the stage for a bullish run. By mid-October, the price had skyrocketed to $62 500. Then, on October 20, it reached an all-time high of $66 400, marking a milestone in the crypto world.

November 2021 brought yet another record-breaking moment for cryptocurrency. Early in the month, Bitcoin's value climbed to $68 300. Between November 9 and 10, it surged to an all-time high of $69 000. However, the market soon experienced a pullback, with Bitcoin trading at $65 800 by November 15.

As we know, the leading cryptocurrency volatility is often influenced by news from major companies and banks. For instance, in 2021, Tesla announced a $1.5 billion Bitcoin purchase, which immediately drove up the digital asset's value. However, when the company later decided to stop accepting Bitcoin as a payment method, the price plummeted by a significant 10%.

In May 2021, China banned banks and payment systems from offering services involving Bitcoin and other cryptocurrencies. Shortly after, the country imposed restrictions on mining and trading activities, forcing miners to relocate. This led to a significant drop in the network’s hashrate, which in turn caused Bitcoin’s price to decline.

That same year, the Republic of El Salvador made history by recognizing Bitcoin as legal tender. Initially, this move fueled an upward trend in Bitcoin's price. However, surprisingly, after the government's endorsement, the cryptocurrency's value began to decline.

Additionally, in 2021, the U.S. Securities and Exchange Commission approved the launch of a Bitcoin-based exchange-traded fund on traditional stock markets. This milestone marked a significant step toward integrating cryptocurrency into mainstream finance.

Crypto experts remain divided on the future Bitcoin's price trajectory. For instance, analysts at JPMorgan predict that its value could reach an impressive $146 000 in the future. However, they emphasize that achieving such heights would require a significant reduction in Bitcoin's volatility.

- 2022

Bitcoin's price in 2022 experienced significant shifts driven by various events. Protests in Kazakhstan, the world's second-largest Bitcoin mining hub, caused the cryptocurrency's value to drop to $42 000. The connection between these events and the price decline is unmistakable, highlighting the impact of geopolitical factors on the crypto market.

That same year, the U.S. Federal Reserve announced plans to raise interest rates and began reducing the central bank's balance sheet. These measures had a direct impact on the crypto market, causing Bitcoin’s price to plummet to $40 000.

On January 22, 2022, Bitcoin's price dropped to $36 000, and then further sank to $34 500.

The downturn in the stock market also impacted Bitcoin’s value since investors braced for tighter U.S. monetary policy. Prior to this, Goldman Sachs had predicted that the Federal Reserve would implement a series of stringent measures in 2022. Experts from the company believed that interest rates would be raised four times throughout the year. Additionally, it was anticipated that, in response to inflation, the Fed would reduce its balance sheet by the summer.

Additionally, Bitcoin's price began to decline due to news about changes in Russia's cryptocurrency policy. The Central Bank of Russia suggested a ban on cryptocurrencies, which created uncertainty in the market. However, on January 27, the Ministry of Finance of the Russian Federation proposed less stringent measures for regulating the crypto sector. The Ministry argued that a complete ban on digital currencies would destabilize the industry.

On January 24, Bitcoin’s price dropped to $33 400, marking its lowest point since the summer of 2021. However, the decline was not limited to Bitcoin alone; other cryptocurrencies also saw similar losses. In February, Bitcoin's price fluctuated, rising to $45 000 at times, only to fall back down to $35 000. Various geopolitical tensions largely drove these price swings. On March 22, Bitcoin's price began to rise steadily, and by March 28, it had reached $48 000, a level not seen since early January.

In April 2022, Bitcoin's price remained highly volatile, fluctuating between $36 000 and $47 000. May saw another significant crash. On May 11, Bitcoin was trading at $28 000, and shortly after, it dropped to $19 000. By June 18, the cryptocurrency plunged further, reaching $17 000. On that day, the total market capitalization of cryptocurrencies fell by a staggering $800 billion.

The Fear and Greed Index, the investor sentiment measure, remained in the red zone throughout May and June 2022, fluctuating between 9 and 11. This extreme sentiment was largely driven by inflation in the United States, which surged to 8.6% in May. In response, the Federal Reserve raised the key interest rate multiple times, contributing to heightened market anxiety.

Additionally, the LUNA and TerraUSD collapse had a significant impact on the decline in cryptocurrency prices. To make matters worse, towards the end of 2022, the FTX exchange filed for bankruptcy. These events combined to push Bitcoin’s price down to $29 000.

- 2023

The year 2023 was marked by significant price fluctuations for Bitcoin. The leading cryptocurrency value ranged between $40 000 and $60 000, ultimately stabilizing around $55 000.

- 2024 – and the Bitcoin’s future

This year marked the end of the battle for a Bitcoin spot ETF. The U.S. Securities and Exchange Commission finally reversed its previous Bitcoin-related products rejection. This decision led to a surge in activity among brokers and contributed to an increase in Bitcoin's price.

In 2024, Bitcoin's price soared by over 70% and set a new record, reaching an impressive $102 000.

Bitcoin remains the leader in the cryptocurrency space. Looking ahead, some experts predict a significant surge in its price, while others foresee a dramatic drop, with the possibility of it falling to as low as $1. The future of Bitcoin remains highly uncertain, and its path will depend on various market, regulatory, and technological factors.

Bitcoin Millionaires

To understand the Bitcoin millionaires rise, you should consider the total Bitcoin supply in circulation. When Bitcoin was created, its supply was capped at 21 million coins. As of today, approximately 18.8 million Bitcoins are in circulation. Additionally, there are limits on how many Bitcoins can be mined each day, meaning the mining rate for the remaining coins will continue to slow down. The last Bitcoin is expected to be mined around the year 2140. This scarcity, combined with increasing demand, has contributed to the numerous Bitcoin millionaires’ creation over the years.

There are reasons to believe that around 5 million Bitcoins have been lost since the cryptocurrency began circulating. It’s widely accepted that this digital asset’s first miner was Satoshi Nakamoto, the system’s protocol creator. If this is true, Satoshi would be a crypto billionaire. Nakamoto is believed to have mined over 22 000 blocks, accumulating more than a million BTC. At the current price, that stash would be worth over $29 billion.

To determine the Bitcoin’s owner, one must examine the addresses of coins in circulation. Currently, there are only three Bitcoin addresses holding more than 100 000 BTC. These wallets’ owners are considered crypto billionaires. Additionally, there are 83 addresses with between 10 000 and 100 000 BTC. In total, 14% of the entire circulating Bitcoin supply is distributed among the 87 wealthiest addresses.

Due to the world’s first cryptocurrency volatility, it’s impossible to predict exactly how many Bitcoins would make someone a billionaire. However, considering the current price, it becomes clear that to attain this status, one would need to hold more than 41 000 BTC.

Along with Satoshi Nakamoto, there are currently four addresses that have reached the threshold of 41 000 BTC. Nakamoto's address contains 1 000 000 BTC, making it hold more coins than any existing company. When combining the Bitcoin holdings of the other four addresses, the total comes to 672 000 BTC. Each of these addresses holds between 100 000 and more than 250 000 BTC.

The Bitcoin’s future: What Lies Ahead?

Today, Bitcoin is a popular financial instrument used by many large organizations. The frequent BTC price drops no longer provoke the same panic level they once did. In fact, people are increasingly inclined to buy more Bitcoin during these price dips, viewing them as opportunities to profit when the digital asset’s price rises again. This behavior indicates growing confidence in Bitcoin’s long-term potential and its evolving role in the global financial system.

The world’s first cryptocurrency, Bitcoin, is being increasingly accepted as a means of payment. However, its investment and speculative functions remain the most significant. Tesla, as well as several other large organizations, started accepting BTC as payment for various goods and services. This shift highlights Bitcoin's growing adoption and its potential to become more integrated into global commerce, alongside its established role as a store of value.

Almost all analysts predict that in the future, Bitcoin's price will reach $100 000 or even $288 000. However, it’s important to consider some less optimistic forecasts. For instance, Scott Minerd, the managing partner of Guggenheim Partners, asserts that there are currently no grounds to expect an increase in BTC's price. Furthermore, he believes that the coin’s price could drop to $15 000 or even $10 000. This opinion divergence highlights the uncertainty surrounding Bitcoin's future, influenced by factors like market volatility, regulation, and adoption trends.

Bitcoin is the world’s first cryptocurrency, operating on a decentralized blockchain protocol, which enables peer-to-peer transactions without the need for intermediaries. Additionally, transferring large sums of money across borders using BTC is much more cost-effective and faster than traditional bank transactions. However, when it comes to everyday transactions, Bitcoin is less efficient. This is due to high transaction fees that arise as the network becomes more congested with increased usage. While Bitcoin is excellent for large international transfers, its scalability for frequent, small transactions remains a challenge.

By examining Bitcoin's growth history, it’s clear that it’s an excellent financial tool* suitable for a trading and investment operations variety. This digital asset has strong potential for further development. It's also important to note that Bitcoin has had a significant influence on the emergence of other cryptocurrencies. The principles underlying Bitcoin's blockchain technology began to be adopted and implemented in many other blockchain projects, contributing to the overall crypto space evolution. As a pioneer, Bitcoin continues to shape the future of digital currencies.

*the information does not constitute financial advice

F.A.Q.

How did Bitcoin come into existence?

There are two key dates in the first cryptocurrency creation history: October 31, 2008, when the article ‘Bitcoin: A Peer-to-Peer Electronic Cash System’ was released, outlining the blockchain’s fundamental principles. On January 3, 2009, the first block was mined.

Who created Bitcoin?

The first cryptocurrency creator is a person or group of people using the nickname Satoshi Nakamoto.

Why is the Bitcoin’s creator anonymous?

The main reason likely lies in the idea of decentralization behind the first cryptocurrency. Bitcoin is an independent system, free from any central authority. Revealing the creator’s identity could lead to pressure on them and attempts to influence Bitcoin’s development and usage.

What was Bitcoin created for?

The key goal of creating the first cryptocurrency was to enable financial management without intermediaries.