Cryptocurrency Screener: 14 Best Apps

A cryptocurrency screener is a web or mobile service that allows traders to monitor the performance of digital assets across key metrics such as liquidity, volatility, trading volume, and more. Over the past few years, dozens of screeners have been developed and widely adopted, each offering different features and levels of functionality. Some are versatile and suitable for everyday trading, while others are tailored to specific strategies or narrow tasks. In this article, we’ll explore how crypto screeners work, what to keep in mind when choosing one, which apps are the most popular right now, and how to select the best option for your needs.

How Does a Crypto Screener Work?

A crypto screener provides real-time information about the most popular digital assets. It helps traders track market data such as prices, volatility, liquidity, trading volume, and other key indicators. Crypto screeners collect their data directly from cryptocurrency exchanges and market data aggregators. They continuously pull different data which can include price quotes, order book information, and trading volumes through APIs, ensuring that the displayed metrics remain accurate and up to date in real time. Available options and displayed metrics can vary for different screeners. Premium screeners usually give more indicators than free ones.

Unlike a simple crypto tracker, which mainly shows price movements and portfolio values, a screener usually offers advanced filtering, sorting, and analytical tools. This makes it not just a way to follow the market, but a decision-making instrument for identifying trading opportunities.

Key Features to Look for in a Crypto Screener

When choosing a crypto screener, it’s important to focus on the tools and functions that will make trading more efficient. A reliable screener should provide real-time data and cover a wide range of digital assets, not just the most popular ones. Customizable filters are essential, as they allow you to sort coins by metrics such as price change, trading volume, volatility, or market capitalization.

Charts and indicators play a key role as well — the ability to quickly switch between timeframes, apply technical analysis tools, and compare assets can help you spot opportunities faster. Alerts and notifications are another must-have feature, making it possible to react immediately to sudden market moves.

Ideally, a screener should be free or at least offer a wide range of features without requiring a paid subscription. This makes the tool accessible to beginners while still being powerful enough for experienced traders.

For more advanced users, integration with exchanges, portfolio tracking, and the ability to save or share templates add even greater value. In short, the best crypto screeners combine flexibility, speed, and depth of analysis, helping you make decisions with confidence in a fast-changing market.

Benefits of Using a Cryptocurrency Screener

Trading cryptocurrencies can be highly profitable, but it is also considered one of the riskiest types of investment. Even when strategies are applied correctly, trades do not always turn out profitable. The goal of every trader is to ensure that overall returns over time outweigh inevitable losses.

Like traditional markets, crypto trading relies heavily on technical and fundamental analysis. However, digital assets have unique characteristics: there are thousands of different coins and tokens, each influenced by factors such as market demand, regulatory news, project updates, or even statements from industry leaders. Because predicting exact price movements is nearly impossible, traders rely on tools like screeners to reduce risks and make more informed decisions.

Crypto screeners typically display large, sortable tables where each row represents a specific cryptocurrency. Users can filter assets by different metrics, apply timeframes, and use built-in indicators to identify promising opportunities. Many screeners also include interactive price charts, customizable alerts, watchlists, and templates for faster analysis.

While no tool can guarantee profits, a screener helps traders systematize their approach, monitor the market more efficiently, and spot trends that may indicate a good entry or exit point. For example, analyzing spikes in trading volume, sudden changes in volatility, or unusual liquidity patterns can provide valuable signals for both short-term and long-term strategies.

However, some screeners only filter coins without providing execution tools or market depth analysis. Therefore, to use a screener effectively, it is important to make sure that the chosen service displays the specific indicators you plan to base your strategy on.

In short, a crypto screener works as a decision-support system: it collects, organizes, and visualizes market data, allowing traders to act quickly and confidently in the ever-changing world of digital assets.

Top 14 Best Cryptocurrency Screener Apps

As the crypto market continues to grow, screeners are becoming essential tools for both beginners and experienced traders. With more platforms available than ever, each offering its own mix of features, pricing models, and user experiences, choosing the right one can feel overwhelming. To make things easier, we’ve put together a list of the 14 best cryptocurrency screener apps that stand out in today’s market. This selection will help you compare options and find the tool that best fits your trading style and goals.

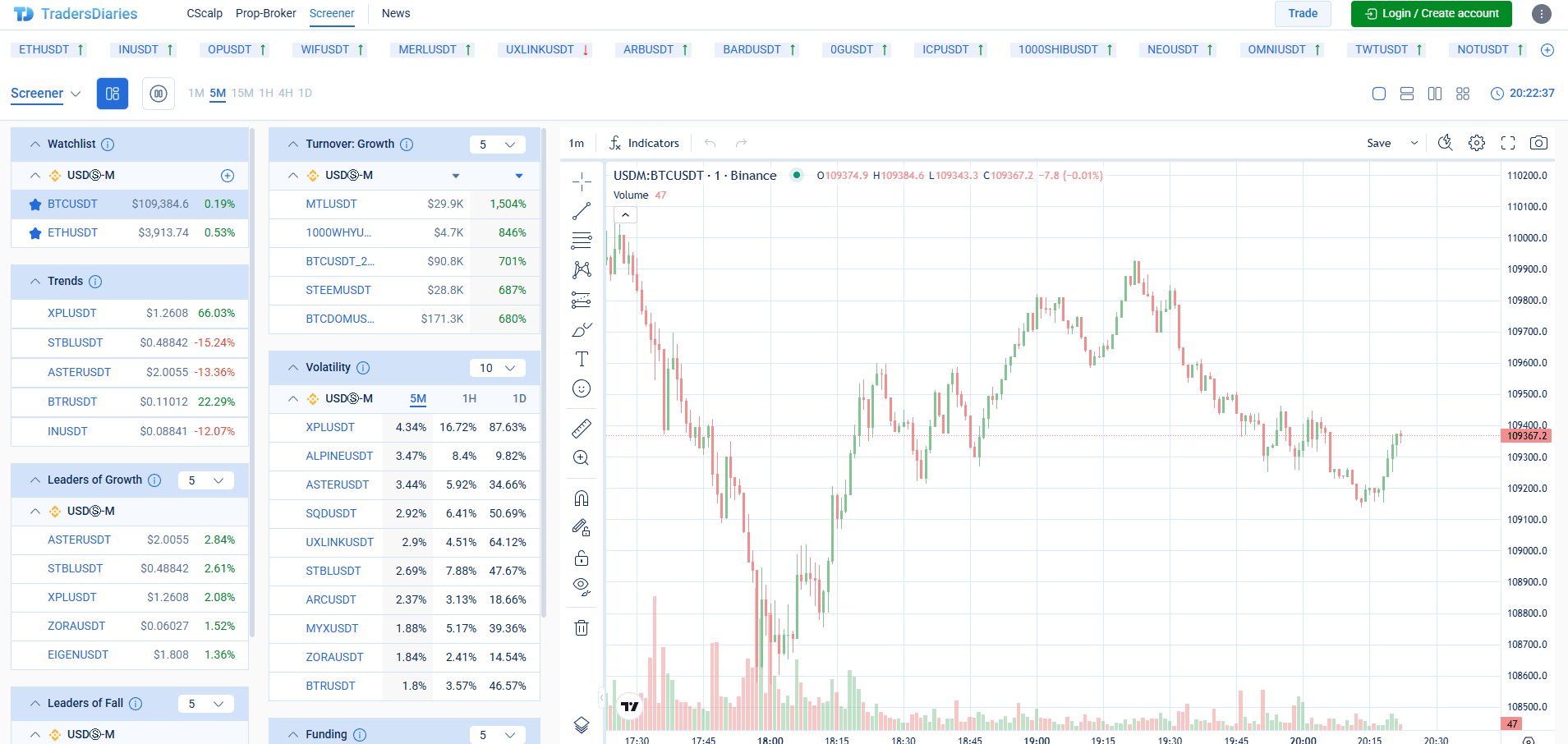

Free Screener by CScalp

Free Screener by CScalp is a completely free tool that provides a robust set of features for crypto traders. The screener supports monitoring up to ~30 of the most volatile instruments (both futures and spot markets) on exchanges like Binance, Bybit, and OKX.

You can view data across multiple timeframes — 5 minutes, 15 minutes, 1 hour, 4 hours, and 1 day — with the table updated regularly to keep metrics fresh and actionable. The interface is customizable: users can edit columns, choose which exchanges to include, and toggle table sections or groups on and off.

Clicking a ticker opens an integrated TradingView chart in the same interface, offering candlestick views, multiple timeframes (from 1 minute to 1 month), and standard technical indicators. The platform supports multiple languages (English, Russian, Ukrainian, etc.), and you can switch between light and dark themes.

Above the main table, there’s also a signal strip showing tickers with predicted price directions, helping users spot potential entry or exit points at a glance.

Because the screener is integrated into the TradersDiaries trading journal from CScalp, you can combine market scanning and trade journaling in one environment.

If users have questions, support is accessible via an online chat icon in the interface.

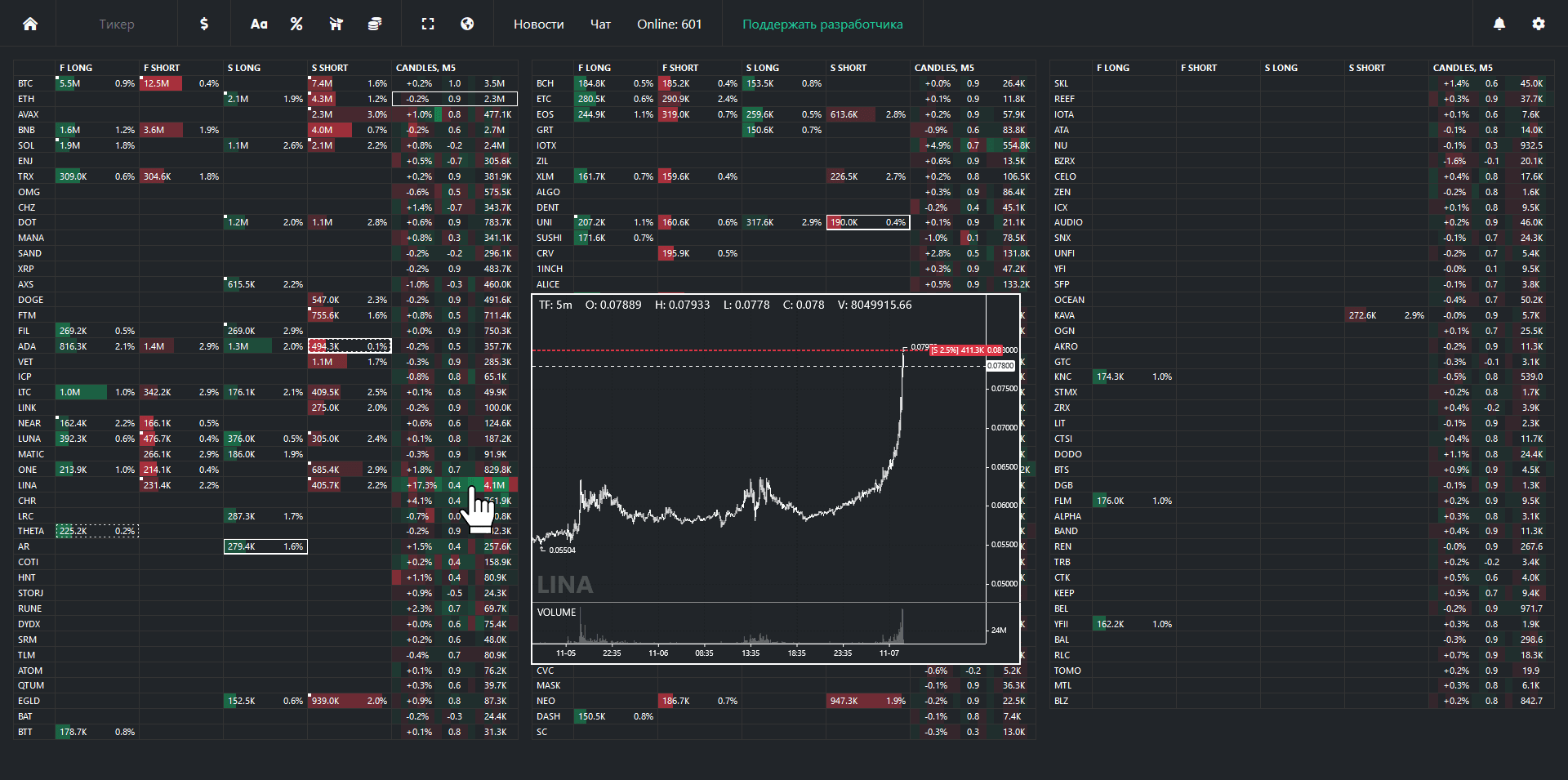

Scalp.live

Scalp.live is a powerful crypto screener integrated with the Binance Futures platform. It allows traders to monitor several key market parameters, such as volatility, order book changes, and the status of horizontal support and resistance levels.

Some of the most useful features include:

- highlighting the largest orders from both spot and futures order books

- displaying orders on the chart as a line for easy visualization

- identifying major market participants

- detecting increased volatility over the last 5–30 candlesticks

- searching for horizontal levels on 5-minute timeframes

Scalp.live is considered one of the most informative and convenient tools for crypto analysis. The service is paid, but its cost is justified by the extensive range of features it provides, making it suitable for serious traders who need advanced market insights.

Bitscreener

Bitscreener is available both as a mobile app (for Android and iOS) and an online service, making it convenient to use across devices. It helps traders track essential market parameters such as:

- current price

- price changes over 1 hour, 1 day, and 1 week

- daily trading volume

- market capitalization and more

The platform allows advanced filtering by type, price, volume, age, circulating supply, and other characteristics. It also supports technical indicators such as SMA 200, SMA 50, RSI, and more.

Bitscreener is offered in both free and paid versions. The free plan provides the same core functionality but with limited search options. Users also gain access to exchange rankings by 24-hour trading volume, heatmaps, and the latest crypto news.

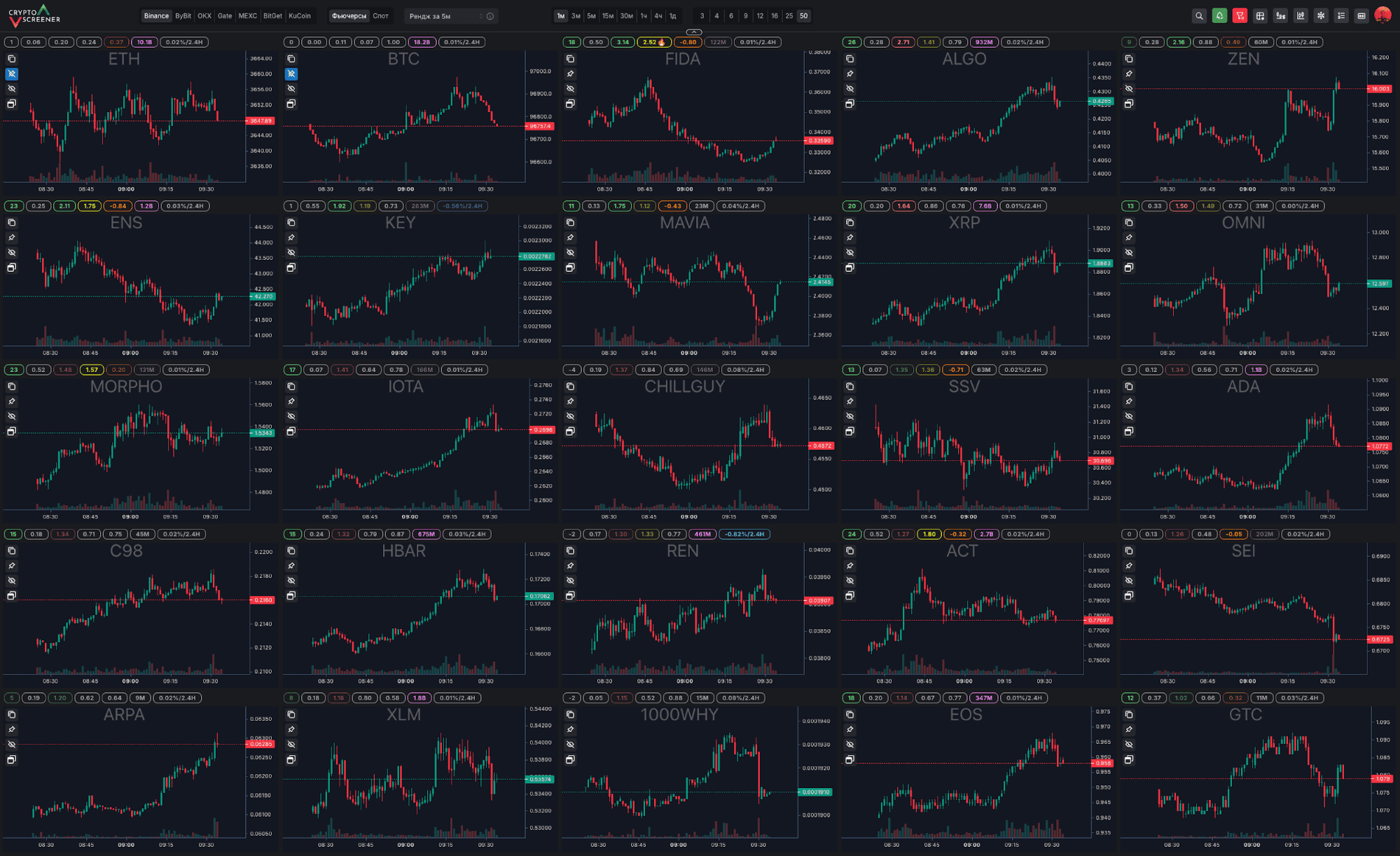

CryptoScreener

CryptoScreener is a reliable and user-friendly tool designed to help traders analyze the cryptocurrency market and react quickly to changes. The platform provides up-to-date information that can be used to make informed decisions about buying or selling digital assets.

Users can customize options such as:

- time of secondary signals

- minimum holding period

- largest futures contract volume

- lower limit for slot volume, and more

This crypto screener allows traders to monitor ongoing market activity closely. Data can be filtered by various metrics, and timeframes can be adjusted to fit different trading strategies, making it a flexible solution for both short-term and longer-term market analysis.

CryptoXScanner

CryptoXScanner allows traders to monitor over 10 different futures market pairs. The platform provides a clear and convenient chart showing current prices and their changes, with customizable timeframes such as 1 minute, 5 minutes, 15 minutes, and more.

Traders can focus on major assets like BTC, ETH, and USDT, while a companion table highlights the best trading pairs based on price, percentage change, and trading volume. This setup makes it easy to spot opportunities quickly and track the most active markets at a glance.

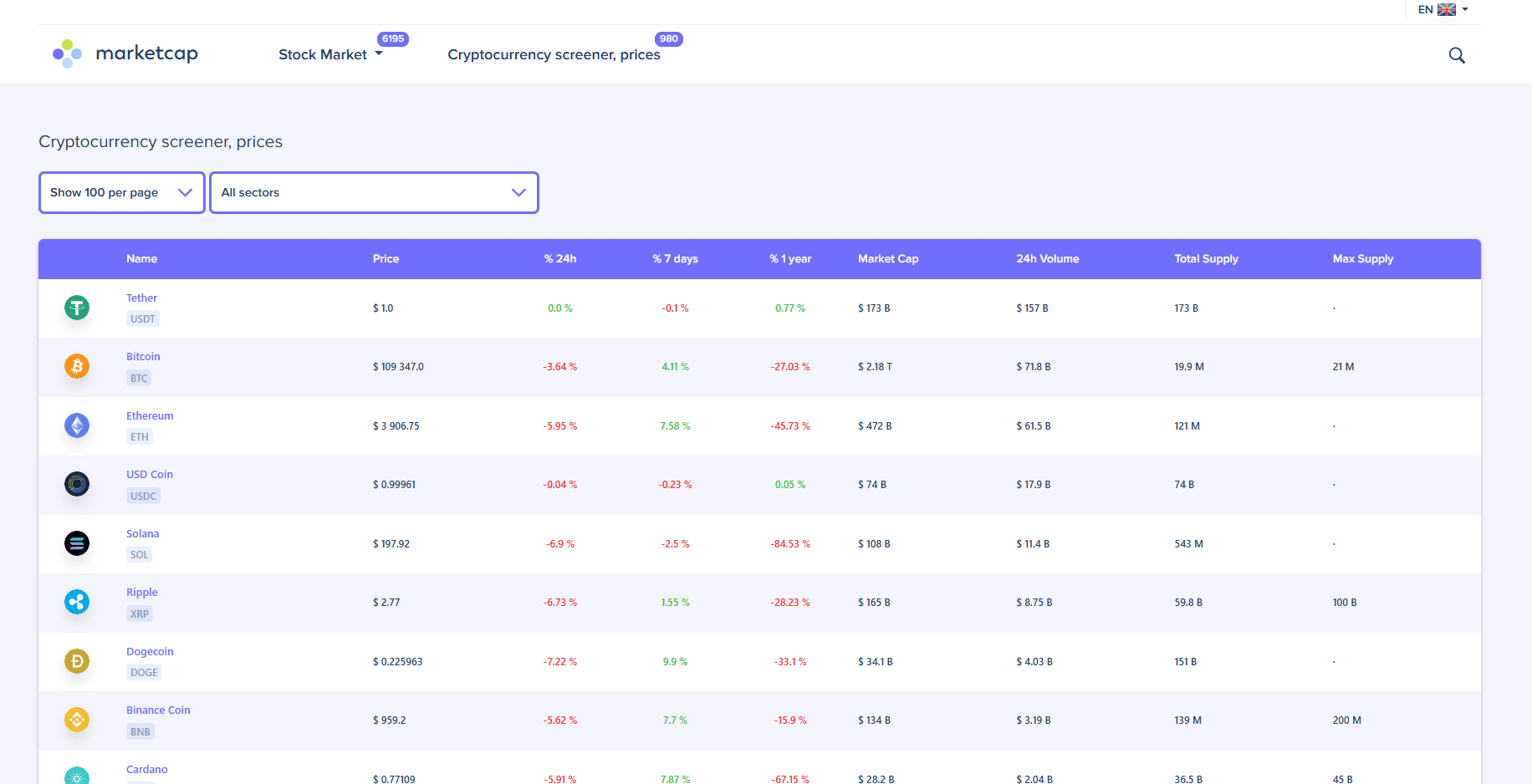

Marketcap

Marketcap is a free tool that allows traders to filter digital assets by various categories, such as DeFi, BNB Smart Chain, smart contracts, Polkadot, collectibles, stablecoins, and more.

The platform also lets users sort cryptocurrencies based on key metrics, including price, percentage change over 24 hours, 7 days, or 1 year, market capitalization, and coin supply (total and circulating). Filters can be adjusted to control how many coins are displayed in the table, making it easier to focus on the most relevant assets.

4Traders MarketScreener

4Traders is a simple and user-friendly tool for analyzing cryptocurrencies. It is free to use and provides both graphical and list-based views of market data. Traders can filter information by various parameters, such as trading volume, price changes, and average volume over a day or a month.

The platform also includes a search function for finding specific assets by entering their ticker or cryptocurrency name. Users can customize the interface by clicking the settings icon, adjusting options such as how volumes are displayed, switching between turnover and raw volume, comparing assets, changing the timezone, and selecting chart types like candlesticks or bars.

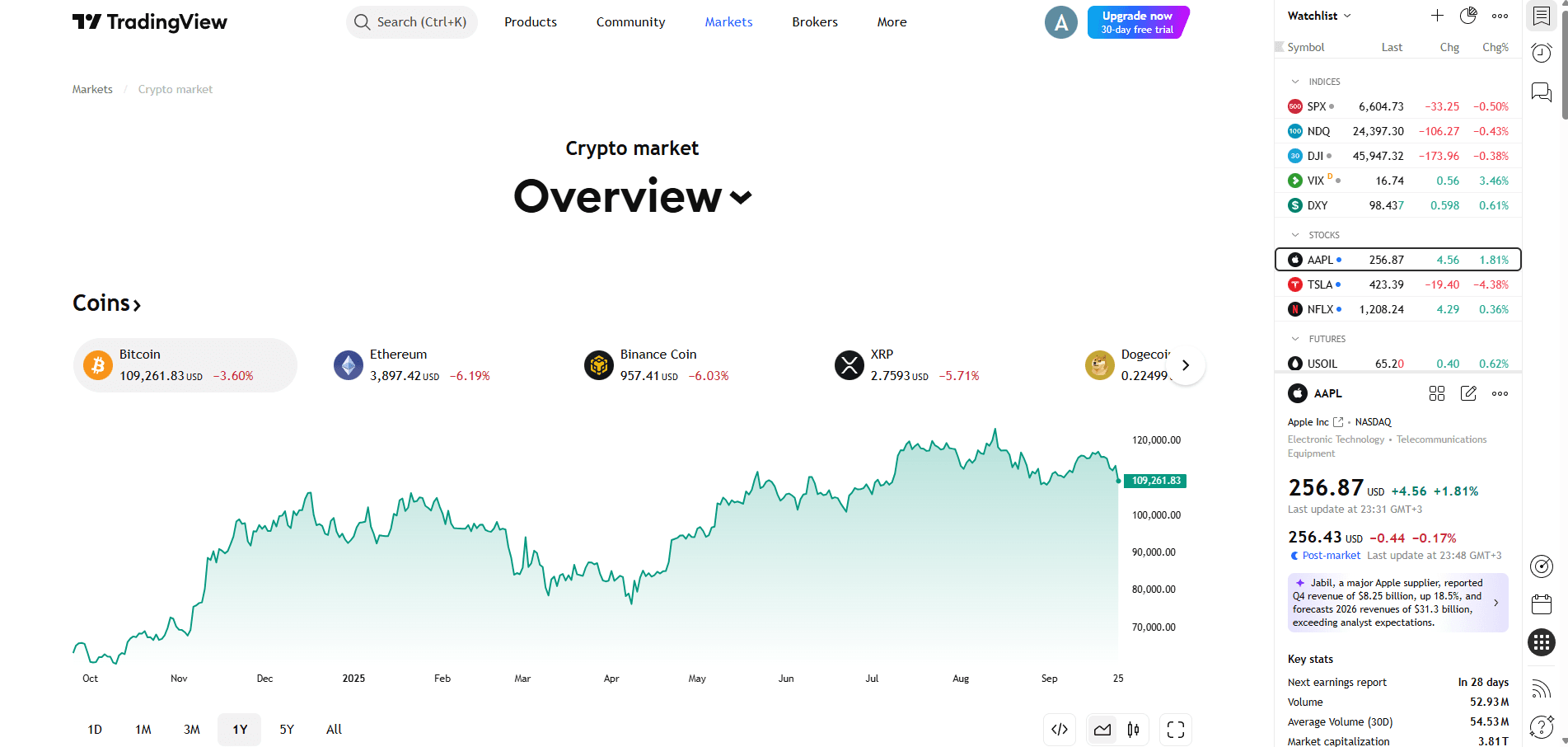

TradingView

TradingView is a versatile crypto screener with a wide range of features and customization options. Traders can filter cryptocurrencies based on performance, general information, trends, and more. Sorting is also available, allowing users to rank assets by market capitalization, technical rating, or volume-to-price ratio.

In the Performance section, timeframes can be set from 1 minute, 5 minutes, 15 minutes, 1 hour, and beyond. Data updates automatically every 10 or 60 seconds, ensuring real-time market insights. The platform is free for visual analysis, but exporting data requires a paid plan, with the most affordable option starting at $14.95 for 30 days.

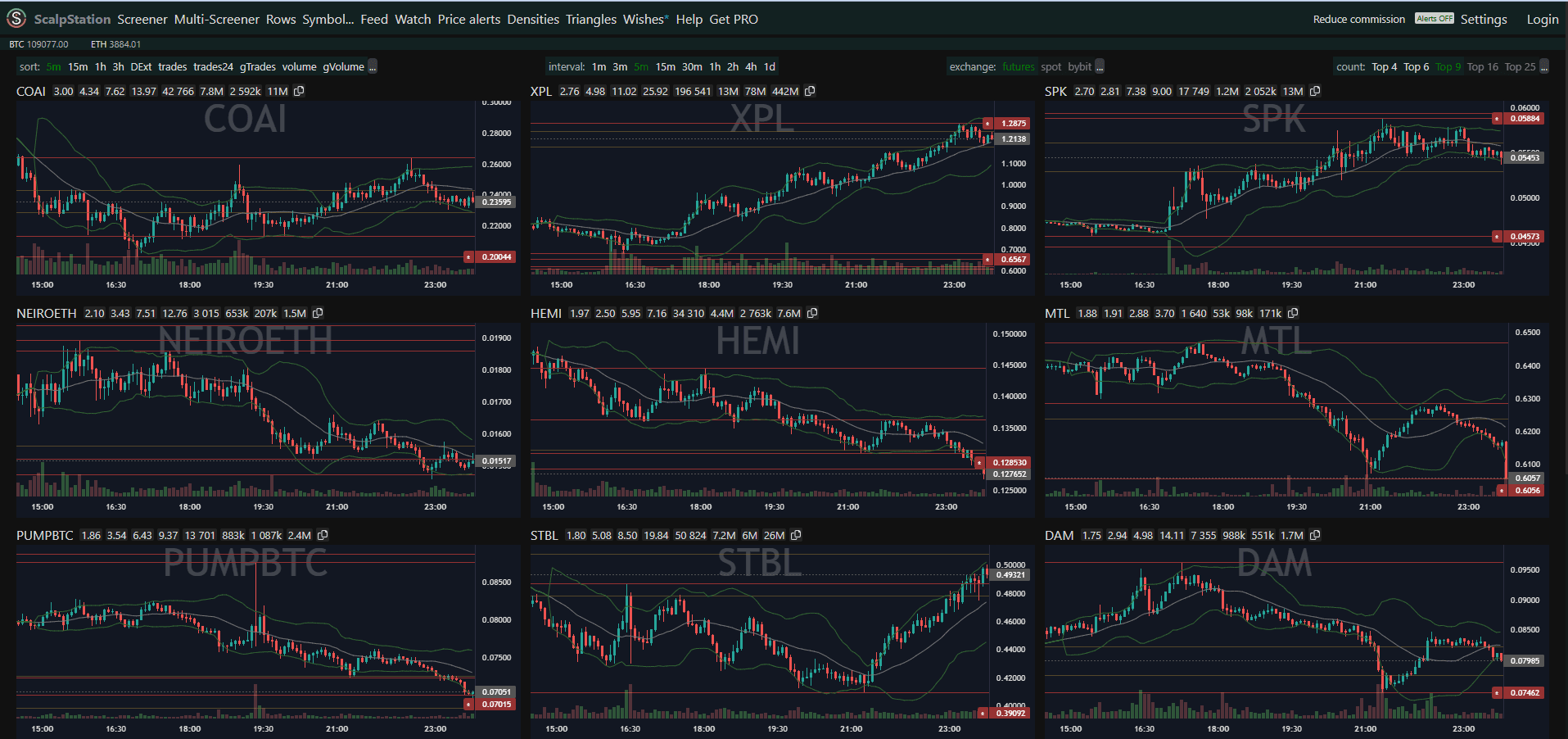

Scalp Station

Scalp Station is a free crypto screener that aggregates information from multiple sources and displays it in real time. It is considered one of the best tools for crypto scalping on Binance. Bitcoin and Ethereum are offered as base currencies, but users can select multiple cryptocurrencies to monitor market volatility.

The screener allows filtering data by levels, volume, peak values, and other metrics. Traders can also adjust the displayed timeframe, making it easy to track short-term price movements and identify potential trading opportunities quickly.

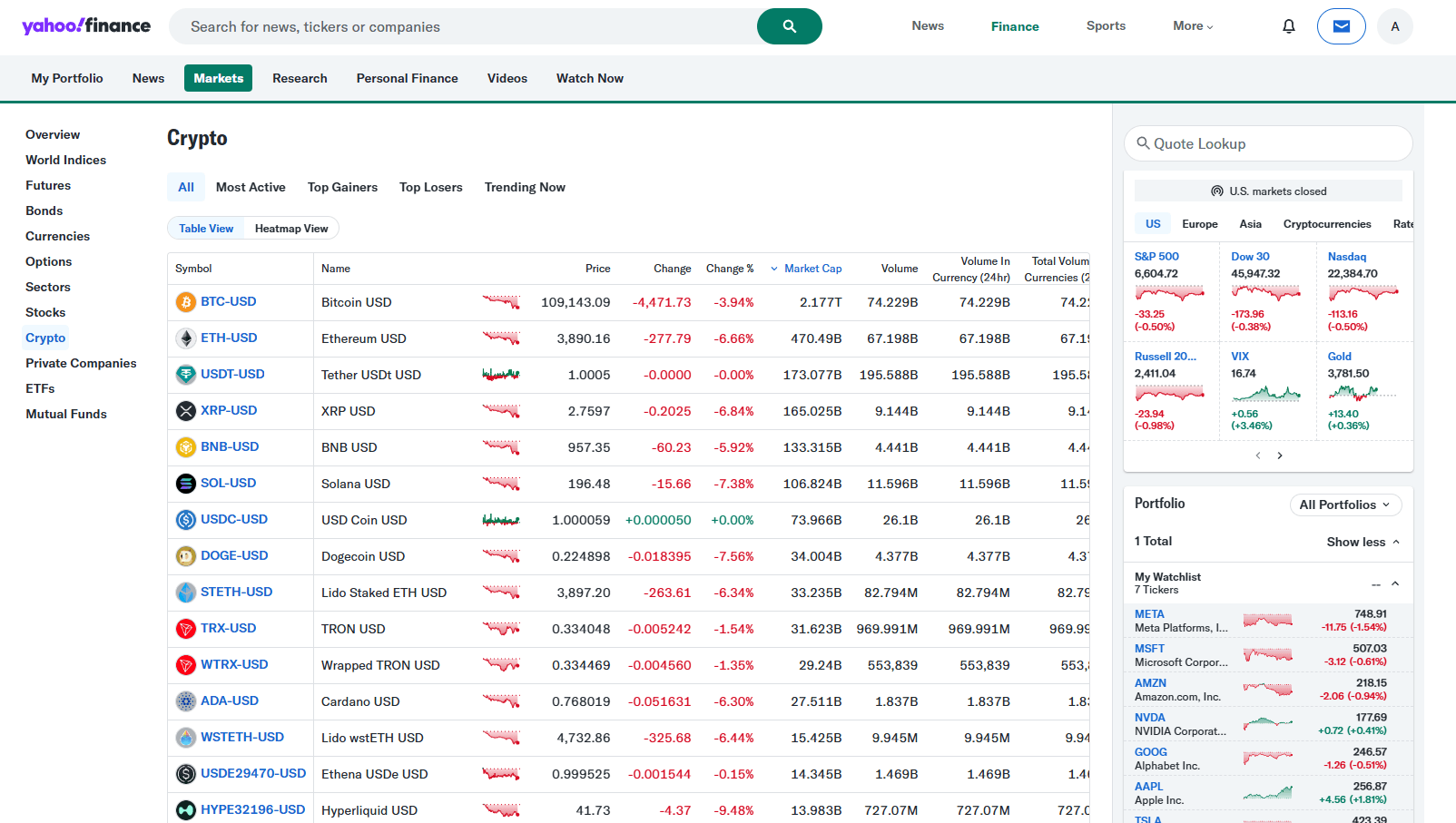

Yahoo Finance

Yahoo Finance allows traders to track hundreds of cryptocurrencies and sort them by key parameters such as price, price fluctuations, percentage change over the last 24 hours, trading volume, and market capitalization.

Unlike some other screeners, Yahoo Finance does not have advanced filters for searching specific coins. However, registered users can customize the screener for their needs, choosing from various financial instruments such as mutual funds, equities, ETFs, futures, and indices.

A standout feature is the Heatmap View, which displays an interactive map showing price movements for several popular cryptocurrencies paired with USD. To see the price, changes over a specific period, or market capitalization of a particular asset, users simply hover over the corresponding pair.

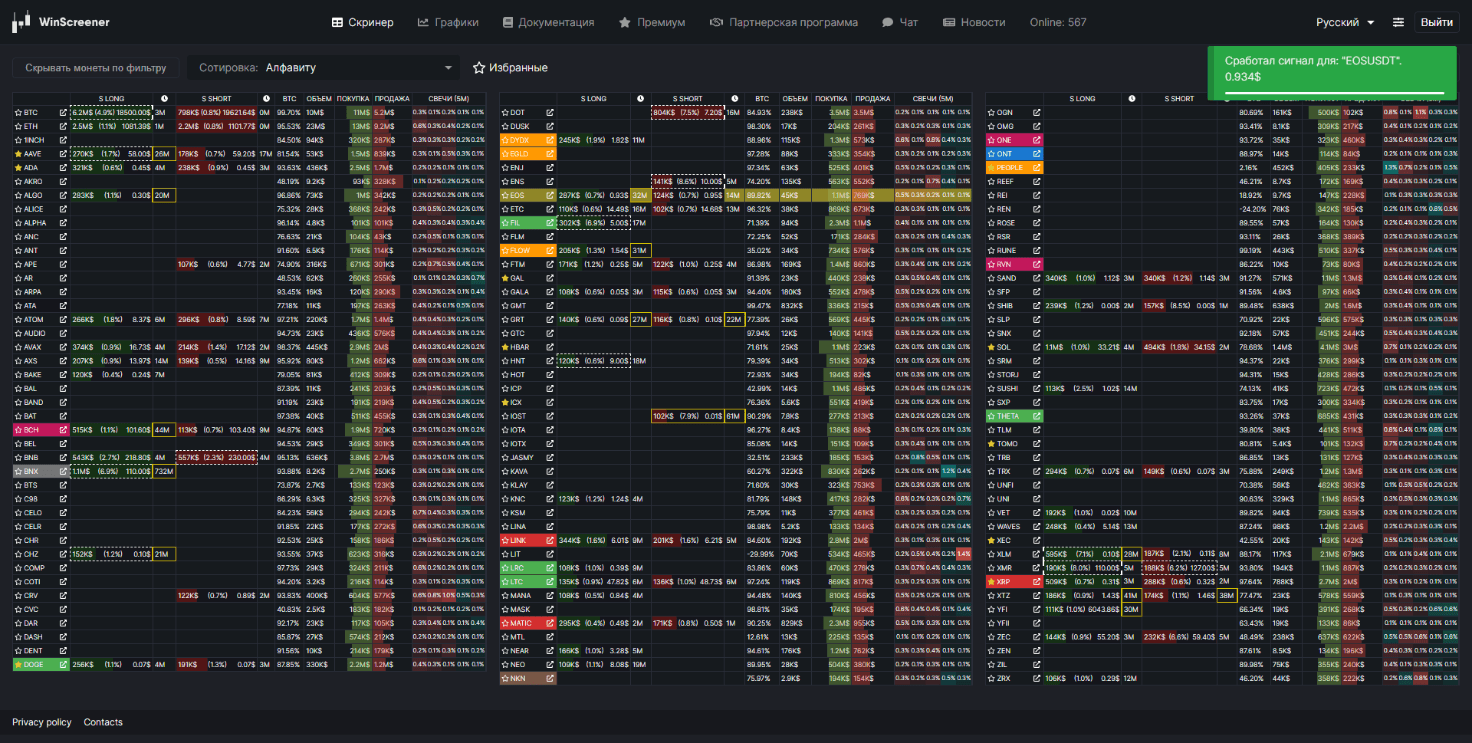

Winscreener

Winscreener is a convenient crypto screener, designed to track limit orders and analyze cryptocurrency prices. Horizontal lines on the charts indicate potential breakouts or price rebounds, while powerful technical indicators help traders respond quickly to market changes and make informed decisions about buying or selling assets.

The platform is paid, with the premium plan unlocking full functionality. Advanced features include adding coins to favorites, highlighting specific assets, receiving notifications, and other enhanced tools. The free version is no longer available, so access to the screener requires a subscription.

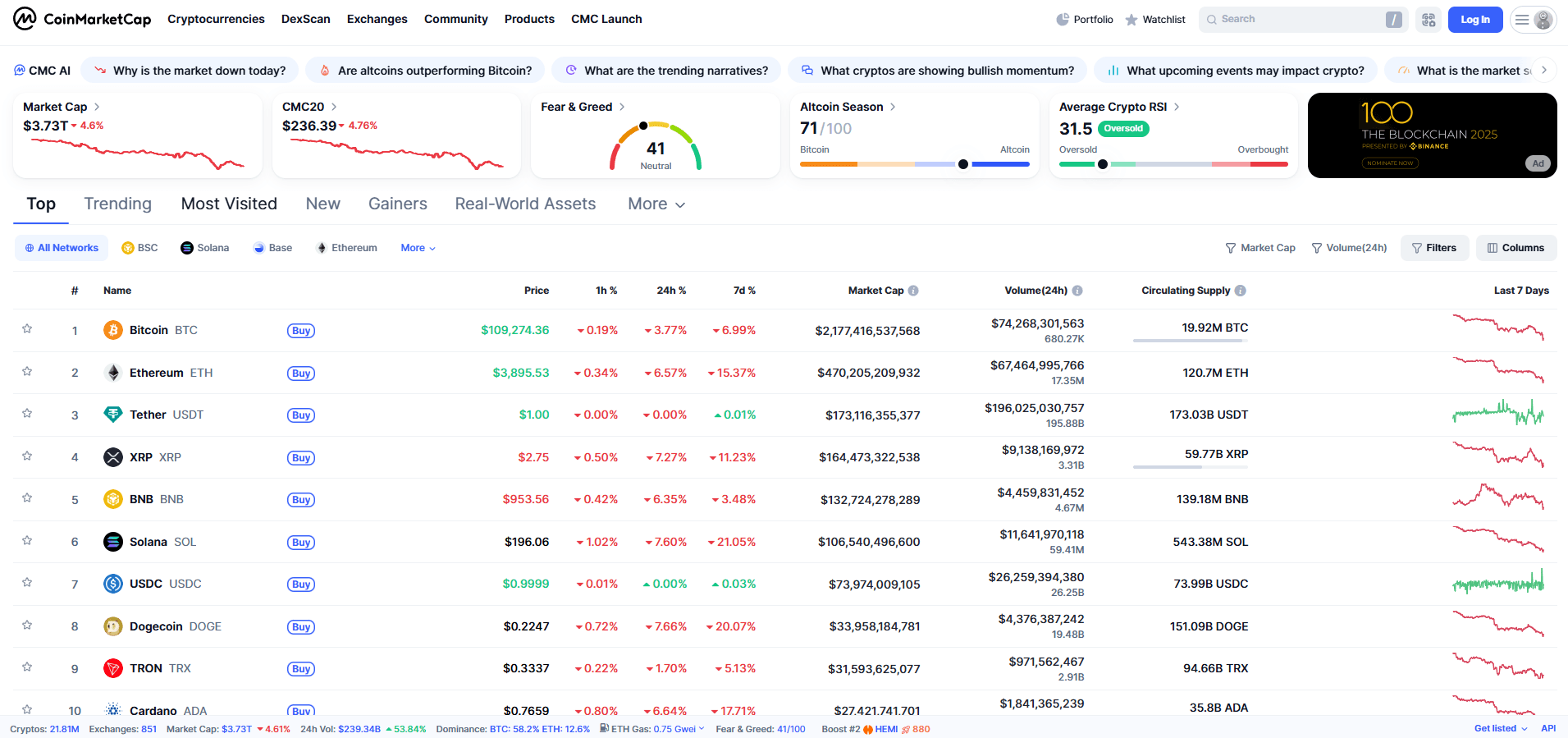

CoinMarketCap

CoinMarketCap was the first crypto screener to introduce the ability to track newly listed digital assets. In April 2020, it was acquired by the cryptocurrency exchange Binance, which raised the standards for listing cryptocurrencies and improved the quality of verification.

The platform remains free to use, and most features can be accessed without registration. CoinMarketCap provides data on prices, market capitalization, trading volumes, and other key metrics for thousands of cryptocurrencies, making it a versatile tool for both beginners and experienced traders.

CoinGecko

CoinGecko is a reliable crypto screener used by experienced traders for many years. Access to its features is completely free.

Compared to CoinMarketCap, CoinGecko has less strict requirements for verifying new assets, which allows moderators to approve listings more quickly. As a result, this screener often displays newly launched tokens faster than many other platforms, making it a useful tool for traders who want to spot emerging opportunities early.

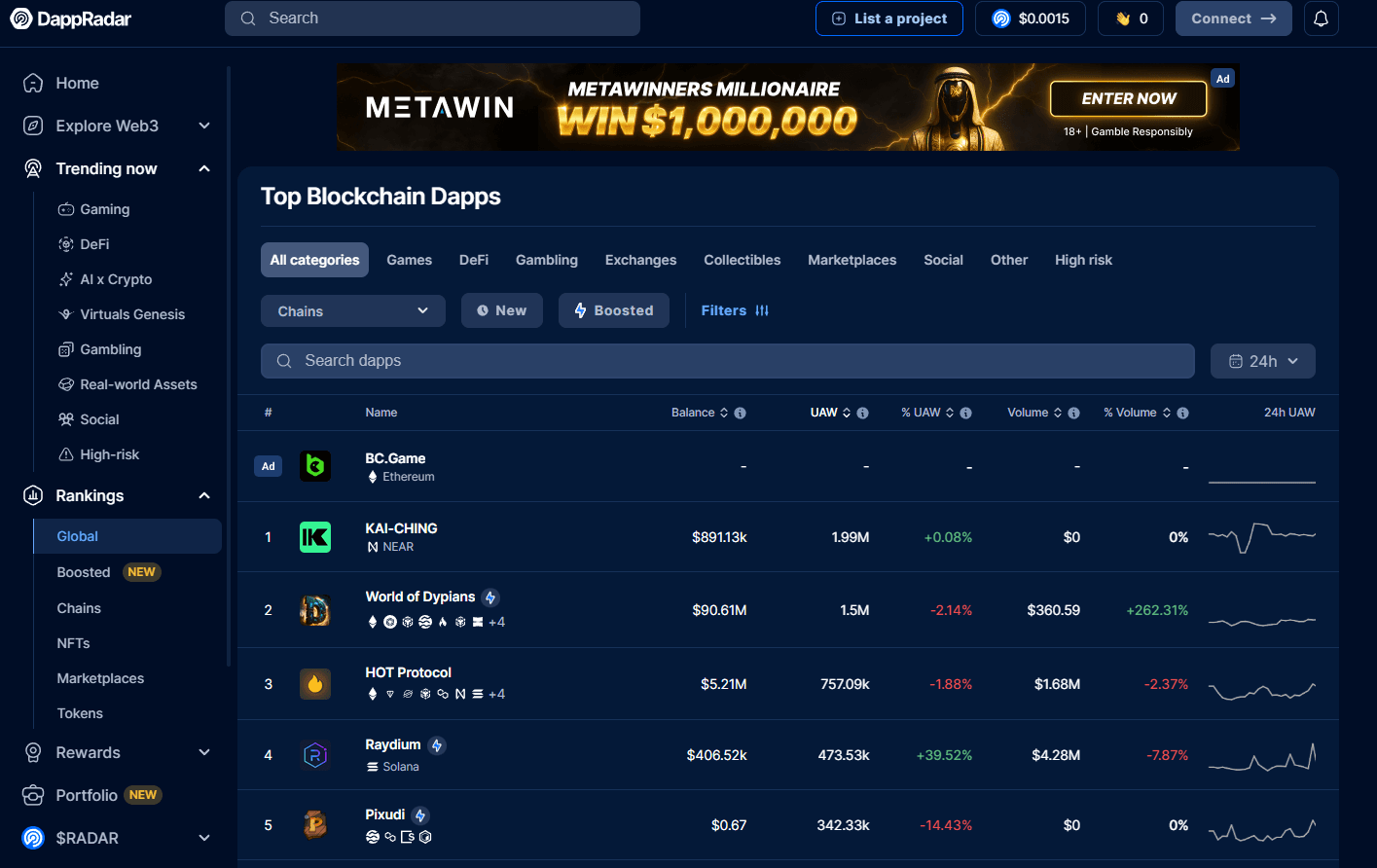

DappRadar

DappRadar is a free service that allows traders to explore decentralized applications (dApps). The platform covers projects in areas such as DeFi, NFTs, gaming tokens, gambling, and exchange tokens.

After registering, users gain access to additional features, including templates, portfolio tracking, notifications, and more. This makes DappRadar a useful tool for both discovering new projects and monitoring ongoing activity in the decentralized ecosystem.

How to Choose the Right Crypto Screener for You

Choosing the right crypto screener depends on your trading style, goals, and level of experience. For beginners, it’s best to start with a free or low-cost tool that offers a clear interface, basic filters, and easy-to-read charts. Experienced traders may prefer advanced screeners with customizable indicators, real-time alerts, integration with exchanges, and portfolio tracking.

Other important factors to consider include the range of supported cryptocurrencies, available timeframes, the accuracy and speed of data updates, and whether the screener provides features like technical analysis tools, heatmaps, or order book insights. Ideally, a good screener should be flexible, fast, and reliable, helping you make informed decisions without overwhelming you with unnecessary complexity.

FAQ

What is a cryptocurrency screener?

A cryptocurrency screener is a web or mobile tool that allows traders to monitor digital assets across key metrics such as price, volatility, trading volume, liquidity, and market capitalization. It helps organize and display market data to identify potential trading opportunities.

How does a crypto screener help traders and investors?

Screeners provide real-time data, sortable tables, interactive charts, alerts, and technical indicators. They allow traders to track trends, spot unusual market activity, and make informed decisions about buying or selling cryptocurrencies.

Are cryptocurrency screeners free to use?

Many screeners offer free access with a wide range of features, such as CoinMarketCap, CoinGecko, or DappRadar. Some advanced platforms like Scalp.live or Winscreener require a paid subscription to unlock full functionality.

What is the difference between a crypto screener and a crypto tracker?

A crypto tracker mainly displays price movements and portfolio values, while a screener provides advanced filtering, sorting, and analytical tools. Crypto Coins Screener act as decision-making instruments, helping users identify trading opportunities rather than just following the market.

Can I customize filters in a crypto screener?

Yes, most screeners allow users to filter cryptocurrencies by metrics such as price changes, volume, volatility, market capitalization, and more. Some also let you adjust timeframes, apply technical indicators, and save or share templates for faster analysis.

Are crypto screeners safe to use?

Screeners collect data directly from exchanges and aggregators via APIs. While they do not execute trades themselves, using a reputable screener is generally safe. Traders should still verify data and exercise caution when making trading decisions.